Last week was a busy one for financial markets in general and FX markets in particular. The dollar staged another advance across the board and the DXY notched a new high. The euro broke to new lows and the British pound remained under pressure. Yen lost ground across the board as stocks continued to rise alongside yield differentials.

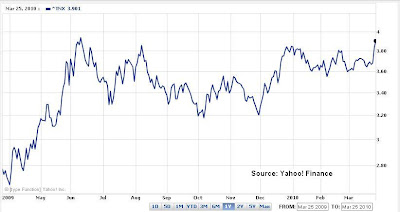

One of the most important and most interesting developments is the rise in Treasury yields, esp. the 10 Yr notes. There are at least two relevant questions to be asked: What is driving the yields? and what are the possible effects. One possible explanation for the yield rise is that the market is pricing in a continued recovery which will, eventually, contribute to rising interest rates. Another possible explanation is that buyers of treasuries are simply bloated. With growing deficits (trade and budget) a huge supply of notes, and concerns over the future of US credit rating, the market may simply be asking for a higher risk premium to hold US debt. In either scenario, the short term expectation is bullish for the dollar.

Greece is expected to issue new bonds this week. The result of this auction will be telling and we will get a better idea as to whether or not the market puts any stock in the recently announce rescue deal for Greece.Either way, we should still expect euro rallies to serve traders as opportunities to reload their shorts rather than a trend reversal. Same goes for the British pound.

Yen was weaker across the board and this is expected to continue as long as we don't get into risk aversion mode. I have been using the S&P 500 as one measure of risk appetite and for the time being, it seems due for a pullback. I know I have been cautious since the middle of March and I also realize the danger in adopting a bearish bias - the more time passes, the more liable I am to become entrenched in my position, waiting for a correction which may only come much, much later. Having said that, I still maintain my view that a short term pullback in the stock market is immanent and may have already started last week. The market climbed a wall of worry and it will descend a wall of reassurance. This is how the game is played. The S&P COT report also shows large speculators being net short for the first time in month - another red flag. The only positive for stocks at this time are the rising yields in bonds. If bonds loose their luster because the marker is pricing in a sustained recovery, we may witness a major capital reallocation from bonds to higher yielding assets like stocks and commodities.

Traveling today so no charts with this post.

Sunday, March 28, 2010

Saturday, March 27, 2010

Commitment of Traders (COT) Reports - 03/23/10

These are the March 26 reports containing data as of 03/26/10. COT graphs below show net positions for Commercials (hedgers), Non-Commercials (large speculators), and Non Reportables (small speculators).

Highlights of this week's COT reports:

1. S&P (e-mini) COT Report - For the first time since October 2008, large speculators are net short. Interestingly, small speculator turned net positive this week for the first time in months. This divergence shows that smart money (non-commercials) and dumb money (non-reportables) are at odds. Isn't that the oldest story on Wall st? If what we are seeing is indeed real distribution -the process in which large players trim down profitable positions- the question must be asked: can the retail investor prop the market's momentum? At any rate, this is definitely a red flag!

2. USD COT Report - Extreme net long positions persist. This week's reading slightly higher than last week.

3. Euro COT Report - New selling pressure is evident in the increased net short positions.

4. GBP COT Report - Extreme bearishness persists and net short positions are at new highs.

5. Commodity Currencies - Both the Aussie and Loonie's COT reports show extreme net long positions are still sustained.

6. JPY COT Report - Net long speculative positions continue to decline.

7. As of this week, I am adding two new reports: Crude Oil and 10 Yr Notes.

CLICK TO VIEW LARGER IMAGE

Highlights of this week's COT reports:

1. S&P (e-mini) COT Report - For the first time since October 2008, large speculators are net short. Interestingly, small speculator turned net positive this week for the first time in months. This divergence shows that smart money (non-commercials) and dumb money (non-reportables) are at odds. Isn't that the oldest story on Wall st? If what we are seeing is indeed real distribution -the process in which large players trim down profitable positions- the question must be asked: can the retail investor prop the market's momentum? At any rate, this is definitely a red flag!

2. USD COT Report - Extreme net long positions persist. This week's reading slightly higher than last week.

3. Euro COT Report - New selling pressure is evident in the increased net short positions.

4. GBP COT Report - Extreme bearishness persists and net short positions are at new highs.

5. Commodity Currencies - Both the Aussie and Loonie's COT reports show extreme net long positions are still sustained.

6. JPY COT Report - Net long speculative positions continue to decline.

7. As of this week, I am adding two new reports: Crude Oil and 10 Yr Notes.

CLICK TO VIEW LARGER IMAGE

Friday, March 26, 2010

Rising Yields Cement Dollar's New Highs

Positive developments yesterday (Thursday) sent stocks and the USD higher. While stocks gave up their gains during the last hour of trading, the dollar remained strong. The greenback gained against all its major counterparts, including the commodity currencies, aided by rising Treasury yields. Here's a quick recap of yesterday's news:

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

- Unemployment numbers came in slightly better than expected.

- Strong earnings/guidance from Best Buy and Qualcomm.

- Citi gained on news suggesting the Treasury will unveil a plan to sell its stake in the bank.

- Bernanke gave the market another fix of its favorite drug - commitment to keeping easy, cheap money flowing.

- France, Germany find common grounds for Greece assistance package involving the IMF (but euro makes new lows)

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

Thursday, March 25, 2010

Introducing Bloomberg "Hacks" Page

Bloomberg.com provides tremendous amounts of information and financial data, but it's not always easy to find or search for. Although virtually all of the data on bloomberg.com (the public site) is delayed, it can still be a valuable resource in assessing long term trends and shed light on current events. For example, you may look at German/Greek spreads to measure the risk premium investors charge to buy Greek debt. Likewise, you may look at the commercial CMBs spreads over treasuries to assess the commercial real-estate sentiment.

I decided to dedicate a separate page to keep track of this information. I will update the page periodically. If you have any suggestions on how to make it better or additional links that can be added, please let me know.

Thanks!

http://forexroy.blogspot.com/p/bloomberg-hacks.html

I decided to dedicate a separate page to keep track of this information. I will update the page periodically. If you have any suggestions on how to make it better or additional links that can be added, please let me know.

Thanks!

http://forexroy.blogspot.com/p/bloomberg-hacks.html

Wednesday, March 24, 2010

Blame it on the Weather

So, it was a really amazing weekend in New York and I was out and about, which explains the absence of my weekly summary/forecast post on Sunday. I have been pretty disciplined about writing my weekend review so I almost forgot how important it was. It is absolutely imperative to review the week that was, study the weekly and monthly charts, take into account recent fundamental developments and anticipate the markets direction based on the charts and calendar of economic events. Then, it is important to take all of that and formulate a working hypothesis for the week - a set of assumptions to frame our trading decisions. Personally for me, it is also important to do all of this on the weekend, when the market is closed and after spending at least 24 hours away from my monitor.

Well, better late than sorry so in lieu of the Sunday review, here's a little mid-week recap - a sort of Tuesday night quarterbacking, if you will. Here we go:

S&P 500

The S&P finished last week above 1150. This was largely seen as a bullish sign with a Friday confirmation close above a strong resistance level. However, until today (Tuesday) the S&P was not able to close above 1166, the resistance level we've identified days ago. Today's break above 1166 was decisive and happened toward the end of the day. It definitely looked like a good number of stop entries triggered on a break above 1170. At any rate, the next short term support/resistance levels for the S&P are 1175 and 1150. A break below 1150 might accelerate selling pressure with support seen at 1130 and 1115. This means that we are currently just a fraction of a point from another resistance level. A pullback at this point is all but certain. But hey, I could be wrong. The question is, what is the catalyst to push the market up or down. For sure, the Fed's commitment to keep rates low is a major factor. On the other hand, the Fed will end its MBS (mortgage backed securities) purchase program this month. No one knows for sure how it will impact mortgage rates and, in turn, real-estate prices but we already know that uncertainty and risk appetite do not go hand in hand. At any rate, if I set my bearish bias aside and just look at the chart, it looks like S&P is set to drift higher to 1200.

USD Index (DXY)

The strong inverse correlation that dominated the relationship between the USD and the S&P for much of 2009 seems like a distant memory. The relatively strong US recovery stands in stark contrast to the situation in the EU and the UK. This macro environment allowed US equities to rise to new monthly highs in tandem with the US dollar. One can only imagine that in a risk aversion scenario, the gap between the USD and the euro/GBP would be even greater - arguably, in such environment, the USD will stand to gain not only against the weak euro and GBP but also against the strong loonie, aussie, and Swiss franc.

As previously noted, the euro and GBP make up nearly 70% of the basket of currencies against which the DXY is calculated. This means that most of the recent strength in the DXY is due to weakness in the euro and pound, both of which face lingering issues and may suffer further weakness.

Euro - Greece

Germany's Merkel changed her stance a couple of days ago when she asserted that the IMF may be the only way to extend help to Greece. At the time the news came out, I thought a good chance for some relief to Greece and the euro was on the cards but that was not the case. A new round of political bickering commenced which helped push the euro even lower. The euro declined to new monthly lows against the Aussie and Swiss franc. As I write these lines, EURUSD is flirting with its 1.3450 support. A break below this level will most certainly trigger some stop sell orders waiting to be activated and send the euro even lower.

Only a clear plan for Greece and a cohesive EU stance can save the euro from sliding further. Euro sentiment remains bearish until then.

British Pound

The GBP suffered a massive slide on the backdrop of a weak UK economy coupled with an upcoming elections and accented with dovish BoE comments. At one point the pound even weakened against the euro. New economic data released today didn't help. Technically speaking, the pound looks the most vulnerable for further decline. At this very moment (3/24/09, midnight), GBPUSD seems well on its way to retest recent support at 1.4880 - 1.4800.

Japanese Yen

The yen maintained most of its strength despite the new highs in equities. As previously noted, at least some of the yen's strength should be attributed to repatriation which should abate by the end of the month, leaving the yen (risk appetite permitting) vulnerable.

Commodity Currencies

The loonie and Aussie continued to dominate the scene, with the loonie outpacing its Australian counterpart. The thought her is that the Aussie is vulnerable to further Chinese tightening but the Canadian dollar is less so. In addition, BOC has yet to raise interest rates while the RBA may not be willing to go much higher at this point.

OK - That's all for the time being. To be continued tomorrow....

Well, better late than sorry so in lieu of the Sunday review, here's a little mid-week recap - a sort of Tuesday night quarterbacking, if you will. Here we go:

S&P 500

The S&P finished last week above 1150. This was largely seen as a bullish sign with a Friday confirmation close above a strong resistance level. However, until today (Tuesday) the S&P was not able to close above 1166, the resistance level we've identified days ago. Today's break above 1166 was decisive and happened toward the end of the day. It definitely looked like a good number of stop entries triggered on a break above 1170. At any rate, the next short term support/resistance levels for the S&P are 1175 and 1150. A break below 1150 might accelerate selling pressure with support seen at 1130 and 1115. This means that we are currently just a fraction of a point from another resistance level. A pullback at this point is all but certain. But hey, I could be wrong. The question is, what is the catalyst to push the market up or down. For sure, the Fed's commitment to keep rates low is a major factor. On the other hand, the Fed will end its MBS (mortgage backed securities) purchase program this month. No one knows for sure how it will impact mortgage rates and, in turn, real-estate prices but we already know that uncertainty and risk appetite do not go hand in hand. At any rate, if I set my bearish bias aside and just look at the chart, it looks like S&P is set to drift higher to 1200.

USD Index (DXY)

The strong inverse correlation that dominated the relationship between the USD and the S&P for much of 2009 seems like a distant memory. The relatively strong US recovery stands in stark contrast to the situation in the EU and the UK. This macro environment allowed US equities to rise to new monthly highs in tandem with the US dollar. One can only imagine that in a risk aversion scenario, the gap between the USD and the euro/GBP would be even greater - arguably, in such environment, the USD will stand to gain not only against the weak euro and GBP but also against the strong loonie, aussie, and Swiss franc.

As previously noted, the euro and GBP make up nearly 70% of the basket of currencies against which the DXY is calculated. This means that most of the recent strength in the DXY is due to weakness in the euro and pound, both of which face lingering issues and may suffer further weakness.

Euro - Greece

Germany's Merkel changed her stance a couple of days ago when she asserted that the IMF may be the only way to extend help to Greece. At the time the news came out, I thought a good chance for some relief to Greece and the euro was on the cards but that was not the case. A new round of political bickering commenced which helped push the euro even lower. The euro declined to new monthly lows against the Aussie and Swiss franc. As I write these lines, EURUSD is flirting with its 1.3450 support. A break below this level will most certainly trigger some stop sell orders waiting to be activated and send the euro even lower.

Only a clear plan for Greece and a cohesive EU stance can save the euro from sliding further. Euro sentiment remains bearish until then.

British Pound

The GBP suffered a massive slide on the backdrop of a weak UK economy coupled with an upcoming elections and accented with dovish BoE comments. At one point the pound even weakened against the euro. New economic data released today didn't help. Technically speaking, the pound looks the most vulnerable for further decline. At this very moment (3/24/09, midnight), GBPUSD seems well on its way to retest recent support at 1.4880 - 1.4800.

Japanese Yen

The yen maintained most of its strength despite the new highs in equities. As previously noted, at least some of the yen's strength should be attributed to repatriation which should abate by the end of the month, leaving the yen (risk appetite permitting) vulnerable.

Commodity Currencies

The loonie and Aussie continued to dominate the scene, with the loonie outpacing its Australian counterpart. The thought her is that the Aussie is vulnerable to further Chinese tightening but the Canadian dollar is less so. In addition, BOC has yet to raise interest rates while the RBA may not be willing to go much higher at this point.

OK - That's all for the time being. To be continued tomorrow....

Thursday, March 18, 2010

Euro May Find Support as Germany Signals IMF Help for Greece Appropriate

EU leadership has been reluctant to even consider the possibility of IMF support for Greece - until today. Germany signaled IMF help may be appropriate after all. The idea is not without merit. The IMF can act somewhat independently of convoluted European politics. In addition, the EU will not be setting a dangerous precedence with a Greek bailout. IMF assistance may or may not be the best solution for Greece. But for the euro, that is not what really matters. What matters for the euro is a decisive plan of action that will put an end to weeks of political bickering.

The euro suffered some its worse one day declines on Thursday but as of this evening, EURUSD found support around 1.36 which coincided with Germany's comments regarding Greece and the IMF. A decisive plan of action, even if it eventually fails, will undoubtedly stoke a euro relief rally and pressure the US dollar.

The euro suffered some its worse one day declines on Thursday but as of this evening, EURUSD found support around 1.36 which coincided with Germany's comments regarding Greece and the IMF. A decisive plan of action, even if it eventually fails, will undoubtedly stoke a euro relief rally and pressure the US dollar.

USD On The Move

US dollar is visibly stronger today across the board. The most obvious factor here is the failed Greek bailout plan. Euro dollar is the most widely traded currency pair and the euro is the biggest component of the DXY, the basket of currencies widely used to measure the dollar's strength. As such, material weakness in the euro will translate to USD strength against most of its trading counterparts.

Technically, the DXY chart looks strong. Despite a break below its recent channel (see chart below), the index bounced off its 50 day MA and, more importantly, bounced off its 79.50 support.

Other factors to consider: the S&P 500 is overextended and likely to pull back or trend sideways. As previously mentioned, 1166 is still a valid resistance for the S&P. A pullback in stocks will likely reduce risk appetite which may help the USD gain vs. the commodities currencies and further boost the dollar. In addition, there's some speculation regarding another unscheduled discount rate hike. The last hike was unscheduled and occurred exactly one month ago.

Taken together, the evidence is pointing to a stronger dollar on the backdrop of risk aversion.

CLICK ON CHART TO SEE LARGER IMAGE

Technically, the DXY chart looks strong. Despite a break below its recent channel (see chart below), the index bounced off its 50 day MA and, more importantly, bounced off its 79.50 support.

Other factors to consider: the S&P 500 is overextended and likely to pull back or trend sideways. As previously mentioned, 1166 is still a valid resistance for the S&P. A pullback in stocks will likely reduce risk appetite which may help the USD gain vs. the commodities currencies and further boost the dollar. In addition, there's some speculation regarding another unscheduled discount rate hike. The last hike was unscheduled and occurred exactly one month ago.

Taken together, the evidence is pointing to a stronger dollar on the backdrop of risk aversion.

CLICK ON CHART TO SEE LARGER IMAGE

Wednesday, March 17, 2010

Too Cautious?

My weekend review contained more than a grain of caution. However, market news and price action since Monday were quite positive. The sanguine mood set in on Monday when Senator Dodd revealed his financial reform blueprint, which the market found less than threatening. Stocks rallied immediately following Mr. Dodd's press conference and S&P futures drifted higher overnight. On Tuesday, the market received another boost, this time, from the FOMC. The Fed delivered another shot of adrenaline as it maintained its "extended period" language. The S&P 500 broke above its 1150 resistance and today (Wednesday), a lower than expected inflation reading pushed the broad market higher.

Let's take another look at the weekend hypotheses and see how they measured up so far:

1. Greece bailout and FOMC statement to set the tone for the week - hawkish "surprises" will set the stage for stronger dollar and pullback in risk appetite - Greece's bailout turned out to be more of a mess than anything else, but sometimes it's the thought that counts. At least for the first two trading days of week, concerns over Greece abated to some degree. Sending the euro higher.

The Fed, however, did not deliver any hawkish surprises in its statement. In fact, since the market was bracing for a possible hint of tightening, equities rallied in relief and the dollar slumped.

2. S&P500 at major resistance level. Break above 1150 expected to be capped at 1166. The more likely scenario, is sideways consolidation or a pullback to key support (1130, 1112). - The S&P did indeed break above 1150 and so far, capped exactly at 1160. Coincident? maybe, but we'll know more by the end of the week.

3. Expect a limited euro rally but capped at 1.3850 or 1.4000. - we did get a bounce in the euro. As of this time, it seems that euro was unable to break 1.3800 and is starting to head back down.

4. GPB priced in for a worst case scenario - as such, counter-trend bounce should not surprise but capped at 1.5550 - GBP bounce back did materialize aided by a better than expected UK unemployment numbers. We should still expect to see selling into GBP rallies.

5. Japanese hints of intervention and easing concerns over Greece, should keep yen on the decline. Any yen rallies should be limited. - USDJPY is pretty much flat since Sunday despite Tuesday's (Japan Wednesday) BoJ commitment for further easing to fight deflationary forces. The yen did loose some ground to the loonie and aussie. At this point, my assumption is that yen strength is a function of repatriation and that yen will continue to decline.

6. Loonie - ever closer for parity.

My view is that caution is still warranted. The recovery is still vulnerable and there are multiple single points of failure. Moreover, Mortgage Backed Securities (MBS) purchases by the Fed are scheduled to end this month and no one can tell for sure what impact it will have on the housing market (presumably, not a good one). Further tightening measures by China can also spook the markets and the eventuality of the Fed's tightening will have to set in at some point.

Let's take another look at the weekend hypotheses and see how they measured up so far:

1. Greece bailout and FOMC statement to set the tone for the week - hawkish "surprises" will set the stage for stronger dollar and pullback in risk appetite - Greece's bailout turned out to be more of a mess than anything else, but sometimes it's the thought that counts. At least for the first two trading days of week, concerns over Greece abated to some degree. Sending the euro higher.

The Fed, however, did not deliver any hawkish surprises in its statement. In fact, since the market was bracing for a possible hint of tightening, equities rallied in relief and the dollar slumped.

2. S&P500 at major resistance level. Break above 1150 expected to be capped at 1166. The more likely scenario, is sideways consolidation or a pullback to key support (1130, 1112). - The S&P did indeed break above 1150 and so far, capped exactly at 1160. Coincident? maybe, but we'll know more by the end of the week.

3. Expect a limited euro rally but capped at 1.3850 or 1.4000. - we did get a bounce in the euro. As of this time, it seems that euro was unable to break 1.3800 and is starting to head back down.

4. GPB priced in for a worst case scenario - as such, counter-trend bounce should not surprise but capped at 1.5550 - GBP bounce back did materialize aided by a better than expected UK unemployment numbers. We should still expect to see selling into GBP rallies.

5. Japanese hints of intervention and easing concerns over Greece, should keep yen on the decline. Any yen rallies should be limited. - USDJPY is pretty much flat since Sunday despite Tuesday's (Japan Wednesday) BoJ commitment for further easing to fight deflationary forces. The yen did loose some ground to the loonie and aussie. At this point, my assumption is that yen strength is a function of repatriation and that yen will continue to decline.

6. Loonie - ever closer for parity.

My view is that caution is still warranted. The recovery is still vulnerable and there are multiple single points of failure. Moreover, Mortgage Backed Securities (MBS) purchases by the Fed are scheduled to end this month and no one can tell for sure what impact it will have on the housing market (presumably, not a good one). Further tightening measures by China can also spook the markets and the eventuality of the Fed's tightening will have to set in at some point.

Sunday, March 14, 2010

Beware the Ides of March

-------------Weekly Summary-----------

1. Greece bailout and FOMC statement to set the tone for the week - hawkish "surprises" will set the stage for stronger dollar and pullback in risk appetite.

2. S&P500 at major resistance level. Break above 1150 expected to be capped at 1166. The more likely scenario, is sideways consolidation or a pullback to key support (1130, 1112).

3. Expect a limited euro rally but capped at 1.3850 or 1.4000.

4. GPB priced in for a worst case scenario - as such, counter-trend bounce should not surprise but capped at 1.5550

5. Japanese hints of intervention and easing concerns over Greece, should keep yen on the decline. Any yen rallies should be limited.

6. Canadian dollar set for another swing at parity with USD.

----------------------------------------------------------

Beware the Ides of March

OK - clearly not the most original headline for a blog post on March 14 but a fitting one nonetheless. As we enter the second half of March, we find the Market in a precarious position and the bulls and the bears at an impasse. This time last year was fortuitous for market participants holding long positions in stocks and high yielding bonds and currencies. After a seven month free-fall, the downside risk was limited, if only by the end-of-the-world sentiment that was baked into cake. When perception changed and market participants realized the end of the world was not quite ready to manifest itself, a dramatic rally in "risky" assets ensued fueled further by massive, unprecedented amounts of cheap money pumped into the global economy.

But after twelve months of remarkable gains, the stock market rally is more mature and its momentum has waned due to lingering concerns over sovereign debt, commercial RE, tentative consumer demand, the eventuality of monetary tightening and the uncertain consequences of central banks' exit strategies. Clearly, this year the risk is more to the downside or, at least some sideways consolidation. Even a breakout above 1150 is no guarantee for extended rally. In fact, strong resistance zones loom just above the 1150 level. And 1225 is a major resistance zone marking a confluence of technical analysis elements (resistance lines, 68.8% Fibonacci retracement level, major moving averages). The combination of technical resistance and questionable fundamentals will no doubt keep risk appetite at bay.

Whether or not we will see the S&P break decisively above 1150 is impossible to predict. However, it is safe to assume that a major move will not take place prior to the FOMC statement on Tuesday. From the data we have, we can expect a more hawkish remarks that may spook the market. We will find out if others at the Fed adopted Mr. Hoenig's hawkish views. Actually, we should expect some hawkish "surprise".

Of course, hawkish remarks from the Fed could be interpreted as a sign of strength and a validation of the recovery - but this is the least likely scenario. Over the past months one could have observed on numerous occasions the close link between the risk trade and loose monetary policies. So where does that leave us?

S&P 500 - The Trend is Your Friend (until it ends)

To get a better understanding, we must zoom out and look at the bigger picture. First, let's look at the weekly chart. Despite a slight negative divergence with the RSI, the chart still looks bullish and a break above 1150 is still within reach.

But what if we break above 1150? For that answer, we must look back to September 2008, the last time the S&P held such lofty levels. We can see from the chart below (the image is spliced to fit the screen) that the real supply zone looms at the 1166 level - the origin of a huge move down. 1166 is as critical (if not more) as 1150 and we are only a few points away.

Bottom line, the S&P is still in "the mouth of the dragon" with sideways consolidation and/or limited pullback to key support areas (1130, 1112)being the most likely scenario. Any upward moves are likely to be capped at 1166.

USD - Time to Move

As expected, the DXY pulled back slightly, stopping just shy of our 79.50 target. After 34 days of sideways consolidation, we can expect the dollar to choose a clear direction. The dollar index COT graphs reveal sustained elevated levels of net long positions. This is inline with the sustained extreme net-short positions for the euro and GBP. In recent weeks, we referred to the USD as win-win on the notion that both highly positive or highly negative economic readings could send the dollar higher. In the short term, we can expect the dollar index to pull back on better than expected economic readings which may ease fears in the EU and the UK while worse than expected readings and/or hawkish Fed statement will send the dollar higher against all but the yen. Key support level for the DXY remains at 79.50

Euro - Shelter from the Storm?

FT reported this weekend that a EU bailout for Greece was in the works. Details are still scarce but we should know more by tomorrow (Monday). A bailout for Greece may provide the euro brief reprieve but rallies expected to be shallow and capped at 1.3850-1.4000. Obviously any bailout from Germany will be contingent upon austerity measures which have already stirred massive strikes and demonstrations across Greece. Euro sentiment remains bearish and the high probability trades would be to short the euro against the US dollar at key resistance levels (1.3850, 1.4000)

GBP -

The worst performing major currency seems to be priced for a worst case scenario. As such, it will not be surprising to see the pound staging a little bounce - especially if we get a dovish Fed statement. GBPUSD could be a good long if it comes back to test 1.4880 or on a break above 1.5230. Just like the euro, GBP sentiment is still bearish and rallies are likely to meet renewed selling pressure. 1.5550, 1.5350, and 1.5200 look like decent levels to short GBPUSD

Yen - Deja Vu All Over Again

Last week we noted our expectation for the yen to weaken against the strong aussie and loonie. That scenario played out nicely. Surprisingly, the yen decline vs. the US dollar was a lot milder as USDJPY finished the week only slightly up. Also, we noted surprising net-long positions among the Commercials both in the recent COT report and last week's. This could be reflecting expectations for temporary yen strength due to repatriation or a bet on a risk aversion sentiment. Whatever the case may be, going long yen may be perilous. Japanese officials already made commented on the yen's recent strength. Any hints of intervention may be enough to cause temporary but sharp declines in the yen.

And the Oscar Goes to....the Loonie!

The Canadian dollar finished another impressive week with gains across the board. Similar to the Aussie, the Canadian dollar has enjoyed the surge in commodity prices (namely, gold and oil). But unlike Australia, Canada's interest rates have yet to be tightened. In addition, further Chinese tightening are perceived to pose greater risk to Australia than to Canada. USDCAD broke a major support last week (1.0200) and is well on its way for parity, its next resistance level.

1. Greece bailout and FOMC statement to set the tone for the week - hawkish "surprises" will set the stage for stronger dollar and pullback in risk appetite.

2. S&P500 at major resistance level. Break above 1150 expected to be capped at 1166. The more likely scenario, is sideways consolidation or a pullback to key support (1130, 1112).

3. Expect a limited euro rally but capped at 1.3850 or 1.4000.

4. GPB priced in for a worst case scenario - as such, counter-trend bounce should not surprise but capped at 1.5550

5. Japanese hints of intervention and easing concerns over Greece, should keep yen on the decline. Any yen rallies should be limited.

6. Canadian dollar set for another swing at parity with USD.

----------------------------------------------------------

Beware the Ides of March

OK - clearly not the most original headline for a blog post on March 14 but a fitting one nonetheless. As we enter the second half of March, we find the Market in a precarious position and the bulls and the bears at an impasse. This time last year was fortuitous for market participants holding long positions in stocks and high yielding bonds and currencies. After a seven month free-fall, the downside risk was limited, if only by the end-of-the-world sentiment that was baked into cake. When perception changed and market participants realized the end of the world was not quite ready to manifest itself, a dramatic rally in "risky" assets ensued fueled further by massive, unprecedented amounts of cheap money pumped into the global economy.

But after twelve months of remarkable gains, the stock market rally is more mature and its momentum has waned due to lingering concerns over sovereign debt, commercial RE, tentative consumer demand, the eventuality of monetary tightening and the uncertain consequences of central banks' exit strategies. Clearly, this year the risk is more to the downside or, at least some sideways consolidation. Even a breakout above 1150 is no guarantee for extended rally. In fact, strong resistance zones loom just above the 1150 level. And 1225 is a major resistance zone marking a confluence of technical analysis elements (resistance lines, 68.8% Fibonacci retracement level, major moving averages). The combination of technical resistance and questionable fundamentals will no doubt keep risk appetite at bay.

Whether or not we will see the S&P break decisively above 1150 is impossible to predict. However, it is safe to assume that a major move will not take place prior to the FOMC statement on Tuesday. From the data we have, we can expect a more hawkish remarks that may spook the market. We will find out if others at the Fed adopted Mr. Hoenig's hawkish views. Actually, we should expect some hawkish "surprise".

Of course, hawkish remarks from the Fed could be interpreted as a sign of strength and a validation of the recovery - but this is the least likely scenario. Over the past months one could have observed on numerous occasions the close link between the risk trade and loose monetary policies. So where does that leave us?

S&P 500 - The Trend is Your Friend (until it ends)

To get a better understanding, we must zoom out and look at the bigger picture. First, let's look at the weekly chart. Despite a slight negative divergence with the RSI, the chart still looks bullish and a break above 1150 is still within reach.

But what if we break above 1150? For that answer, we must look back to September 2008, the last time the S&P held such lofty levels. We can see from the chart below (the image is spliced to fit the screen) that the real supply zone looms at the 1166 level - the origin of a huge move down. 1166 is as critical (if not more) as 1150 and we are only a few points away.

Bottom line, the S&P is still in "the mouth of the dragon" with sideways consolidation and/or limited pullback to key support areas (1130, 1112)being the most likely scenario. Any upward moves are likely to be capped at 1166.

USD - Time to Move

As expected, the DXY pulled back slightly, stopping just shy of our 79.50 target. After 34 days of sideways consolidation, we can expect the dollar to choose a clear direction. The dollar index COT graphs reveal sustained elevated levels of net long positions. This is inline with the sustained extreme net-short positions for the euro and GBP. In recent weeks, we referred to the USD as win-win on the notion that both highly positive or highly negative economic readings could send the dollar higher. In the short term, we can expect the dollar index to pull back on better than expected economic readings which may ease fears in the EU and the UK while worse than expected readings and/or hawkish Fed statement will send the dollar higher against all but the yen. Key support level for the DXY remains at 79.50

Euro - Shelter from the Storm?

FT reported this weekend that a EU bailout for Greece was in the works. Details are still scarce but we should know more by tomorrow (Monday). A bailout for Greece may provide the euro brief reprieve but rallies expected to be shallow and capped at 1.3850-1.4000. Obviously any bailout from Germany will be contingent upon austerity measures which have already stirred massive strikes and demonstrations across Greece. Euro sentiment remains bearish and the high probability trades would be to short the euro against the US dollar at key resistance levels (1.3850, 1.4000)

GBP -

The worst performing major currency seems to be priced for a worst case scenario. As such, it will not be surprising to see the pound staging a little bounce - especially if we get a dovish Fed statement. GBPUSD could be a good long if it comes back to test 1.4880 or on a break above 1.5230. Just like the euro, GBP sentiment is still bearish and rallies are likely to meet renewed selling pressure. 1.5550, 1.5350, and 1.5200 look like decent levels to short GBPUSD

Yen - Deja Vu All Over Again

Last week we noted our expectation for the yen to weaken against the strong aussie and loonie. That scenario played out nicely. Surprisingly, the yen decline vs. the US dollar was a lot milder as USDJPY finished the week only slightly up. Also, we noted surprising net-long positions among the Commercials both in the recent COT report and last week's. This could be reflecting expectations for temporary yen strength due to repatriation or a bet on a risk aversion sentiment. Whatever the case may be, going long yen may be perilous. Japanese officials already made commented on the yen's recent strength. Any hints of intervention may be enough to cause temporary but sharp declines in the yen.

And the Oscar Goes to....the Loonie!

The Canadian dollar finished another impressive week with gains across the board. Similar to the Aussie, the Canadian dollar has enjoyed the surge in commodity prices (namely, gold and oil). But unlike Australia, Canada's interest rates have yet to be tightened. In addition, further Chinese tightening are perceived to pose greater risk to Australia than to Canada. USDCAD broke a major support last week (1.0200) and is well on its way for parity, its next resistance level.

Labels:

Euro,

FOMC,

Greece,

USD,

weekly highlights,

Yen,

Yen intervention

Saturday, March 13, 2010

Commitment of Traders (COT) Reports - 03/09/10

New Commitment of Traders (COT) graphs. This is the March 12 report (data as of Tuesday, March 9). Graphs display net positions for Commercials, non-Commercials, and non-Reportable traders.

Little changed since last weeks reports so we'll keep comments short. Strong net-long position are still evident in the S&P500 report as well as the dollar index, while the GBP and euro are still at extreme net-short positions.

The aussie dollar and the loonie are still gathering strength as speculators added to their net long positions - now at extreme levels.

Perhaps the only surprise this week is the Japanese yen COT report. It shows and increased net-long position which is quite contrary to what we'd expect.

CLICK ON THE GRAPHS TO ENLARGE

S&P 500 (e-mini) COT Report

US Dollar Index (DXY) COT Report

Australian Dollar (AUD) COT Report

Canadian Dollar (CAD) COT Report

Japanese Yen (JPY) COT Report

Little changed since last weeks reports so we'll keep comments short. Strong net-long position are still evident in the S&P500 report as well as the dollar index, while the GBP and euro are still at extreme net-short positions.

The aussie dollar and the loonie are still gathering strength as speculators added to their net long positions - now at extreme levels.

Perhaps the only surprise this week is the Japanese yen COT report. It shows and increased net-long position which is quite contrary to what we'd expect.

CLICK ON THE GRAPHS TO ENLARGE

S&P 500 (e-mini) COT Report

US Dollar Index (DXY) COT Report

Euro COT Report

British Pound (GBP) COT Report

Canadian Dollar (CAD) COT Report

Japanese Yen (JPY) COT Report

Thursday, March 11, 2010

Another Wild Card Friday

Unemployment numbers released this morning came in worse than expected and the market did what? you guessed it....it went up! In a mysterious manner, less than positive news somehow have a calming affect over the markets as fear abates and risk trade is back on. The S&P500 stopped dead in its tracks at the 1150 level. But other indexes like the Nasdaq, Russell 2000, Dow Jones Transportation, to name a few have already extended gains beyond their January highs. Lagging behind are the financials. Banks are among the most vulnerable with respect to exposure to sovereign debt. Although the situation in Greece seems slightly better now, the country is still faced with wide spread strikes and demonstrations, with some violent outbursts. The sustained demonstrations call into question the eventual success of the Greek austerity plan and remind us that market sentiment is fragile at best.

Friday's retail numbers and consumer confidence report will be key. If the risk trade is to sustain its momentum, it will need some better economic readings than what we've been seeing lately. The uptrend is decisively strong, and a break above 1150 will most likely occur with a gap up from today's close. Lousy retail numbers, however, are likely to dampen the flames. Because even if Greece's problems become completely contained, lack of consumer participation is still a major drag.

As expected, the US dollar has been consolidating and slightly pulling back on the backdrop of mild economic readings. As we've mentioned, the dollar is a win-win if we see either very strong readings or very bad readings - mild economic readings are the dollar's kryptonite. Still, any DXY pullbacks are expected to be shallow since both the euro and the GBP remain largely under pressure.

As fear dissipated from the markets, the yen has receded considerably, a trend likely to continue over the next few days.

Friday's retail numbers and consumer confidence report will be key. If the risk trade is to sustain its momentum, it will need some better economic readings than what we've been seeing lately. The uptrend is decisively strong, and a break above 1150 will most likely occur with a gap up from today's close. Lousy retail numbers, however, are likely to dampen the flames. Because even if Greece's problems become completely contained, lack of consumer participation is still a major drag.

As expected, the US dollar has been consolidating and slightly pulling back on the backdrop of mild economic readings. As we've mentioned, the dollar is a win-win if we see either very strong readings or very bad readings - mild economic readings are the dollar's kryptonite. Still, any DXY pullbacks are expected to be shallow since both the euro and the GBP remain largely under pressure.

As fear dissipated from the markets, the yen has receded considerably, a trend likely to continue over the next few days.

Unemployment Figures Fail to Impress

Unemployment claims diminished by 6000 since last week's reading but the number was still worse than expected. The mild improvement was not enough to impress, sending futures on the S&P lower and the yen higher. The S&P is still in a precarious position both technically and fundamentally and reflects disequilibrium between forward looking optimism and lower interest rates on the one hand, and meek economic readings coupled with a wide array of lingering concerns on the other.

Still, if the S&P manages to push higher in the face of such news, that would be a bullish sign and, contrary to reason, may be just the catalyst to send the S&P above its 1150 resistance.

Still, if the S&P manages to push higher in the face of such news, that would be a bullish sign and, contrary to reason, may be just the catalyst to send the S&P above its 1150 resistance.

Tuesday, March 9, 2010

S&P500 - In the Mouth of the Dragon

The S&P500 made a small but important move today, closing up barely two points for the day. The broad market index advanced as high as 1145 but gave up most of its gains before the closing bell. This is hardly surprising. The S&P is right in the middle of a strong resistance zone or, as I like to call it, the mouth of the dragon.

Without a question, selling pressure will be present at this level. First, there are those who bought just around the January highs and are now at break-even and just can't wait to get out and end their pain. And then, there are those who pledged to take profit at 1150 but didn't and are now getting a second chance. Lastly, there are still many bears out there. For them, this is a great time to short the market for one simple reason - they can quantify risk (i.e. they know where to set a stop and have a pretty good idea of potential reward).

We can also expect buying to be tepid at best. After climbing a "wall of worry", the market will need some encouraging data/news to break through the 1150 ceiling. In the absence of positive data or, worse, in the event of bad economic data, we can expect with a high degree of certainty that the stock market will succumb to reality and pull back.

There are, however, a few encouraging signs. First, the Nasdaq Composite Index has already closed above its January high. Technology is a favorite sector as many analyst predict it will lead the recovery. In addition, the DJ Transportation Index is also at its January high. As for the S&P500, despite its end of day retreat, it was able to pierce through the 1140 level which is the lower which is the lower boundary of the resistance zone (see the two red lines in the chart below).

We must also pay attention to the our fear gauges - the yen and the VIX, both of which declined today. The yen actually did not regain any strength, even after the stock market closed. This is a strong indication that fear has abated to some degree.

It is impossible to guess what will happen next. The chance of a pull back in stocks is high. Depending on its severity, such a pull back will cause the dollar and yen to rise. A strong break to the upside might also cause the dollar to rise, especially against the euro and GBP, and the yen will slide. The most critical reports this week, which are likely to impact the markets direction, are the unemployment report on Thursday and retail on Friday.

Without a question, selling pressure will be present at this level. First, there are those who bought just around the January highs and are now at break-even and just can't wait to get out and end their pain. And then, there are those who pledged to take profit at 1150 but didn't and are now getting a second chance. Lastly, there are still many bears out there. For them, this is a great time to short the market for one simple reason - they can quantify risk (i.e. they know where to set a stop and have a pretty good idea of potential reward).

We can also expect buying to be tepid at best. After climbing a "wall of worry", the market will need some encouraging data/news to break through the 1150 ceiling. In the absence of positive data or, worse, in the event of bad economic data, we can expect with a high degree of certainty that the stock market will succumb to reality and pull back.

There are, however, a few encouraging signs. First, the Nasdaq Composite Index has already closed above its January high. Technology is a favorite sector as many analyst predict it will lead the recovery. In addition, the DJ Transportation Index is also at its January high. As for the S&P500, despite its end of day retreat, it was able to pierce through the 1140 level which is the lower which is the lower boundary of the resistance zone (see the two red lines in the chart below).

We must also pay attention to the our fear gauges - the yen and the VIX, both of which declined today. The yen actually did not regain any strength, even after the stock market closed. This is a strong indication that fear has abated to some degree.

It is impossible to guess what will happen next. The chance of a pull back in stocks is high. Depending on its severity, such a pull back will cause the dollar and yen to rise. A strong break to the upside might also cause the dollar to rise, especially against the euro and GBP, and the yen will slide. The most critical reports this week, which are likely to impact the markets direction, are the unemployment report on Thursday and retail on Friday.

Monday, March 8, 2010

The Real Cost of Education

An old adage says that education will only cost you once but ignorance will cost you over and over again. Nowhere is this more true than in the financial markets, where ignorance will certainly destroy your account. Like so many others, I was caught off-guard by the crash of 2008. But instead of burying my head in the sand, I decided to learn as much as I could about trading and the financial markets. I began by amassing a mountain of books (all, I later found out, trading "classics") and reading them with absolute attention. I was determined to grow my knowledge, and I did.

But reading books did not satisfy me. I am a skeptical person by nature so I didn't know which author I could trust. In addition, the more I read, the more questions I wanted to ask - but you can't ask a book can you? Then one day, I met an old friend for lunch. We talked about trading, and the markets and I told him about my search for practical trading knowledge. He then told me about a trading school he heard about - a place that teaches you to trade hands-on, taking real-time trades in class. Immediately I was intrigued. When I got home, I looked it up. It was the first time I had heard about the Online Trading Academy (OTA).

After spending a few minutes on their site I made an appointment with one of their education consultants. I was temped to sign up right then and there but, as I already mentioned, I am a skeptic. So I took a couple of days to think it over and realized I was either going to spend my tuition on education, or give it away to the market with no return on my investment. I went back and signed up.

Once in class, I quickly realized I made the right decision. Just being around other folks who shared my goals was priceless. You can learn so much from other people's questions, their struggles, their mistakes and successes. One of the crucial factors in my decision to sign up was OTA's lifetime retake policy which allows you to retake a class, for no extra charge, as many times as you like, which means you can take the same class with different instructors. I knew this was an important feature and I was proven right. I took full advantage of the retake policy and learned something new each time I retook the class. The different instructors I came across had distinct trading styles and that helped me formulate my own personal style that suited me and my personality best. The staff at the OTA locations I attended was great so it was always a pleasure to go back. Retaking classes helped me internalize the most basic but most important concepts of risk management and discipline.

Another added benefit of attending OTA is their commitment to their students' success.On more than one occasion, I was able to contact one of my instructors for additional information. Just recently, I needed to clarify something I didn't quite understand and I contacted one of my instructors, Brandon Wendell. Within hours, he responded back to me with an answer. It's a good feeling to know you have a trader of his caliber in your corner.

Sam Seiden, OTA's Director of Online Education, can often be heard saying that trading is transfer of accounts from those who don't know to those who do. If you have any experience in trading, you know that's so true. So, on which side would you rather be?

For some free (but valuable) stuff from the OTA check out: Lessons from the Pros

But reading books did not satisfy me. I am a skeptical person by nature so I didn't know which author I could trust. In addition, the more I read, the more questions I wanted to ask - but you can't ask a book can you? Then one day, I met an old friend for lunch. We talked about trading, and the markets and I told him about my search for practical trading knowledge. He then told me about a trading school he heard about - a place that teaches you to trade hands-on, taking real-time trades in class. Immediately I was intrigued. When I got home, I looked it up. It was the first time I had heard about the Online Trading Academy (OTA).

After spending a few minutes on their site I made an appointment with one of their education consultants. I was temped to sign up right then and there but, as I already mentioned, I am a skeptic. So I took a couple of days to think it over and realized I was either going to spend my tuition on education, or give it away to the market with no return on my investment. I went back and signed up.

Once in class, I quickly realized I made the right decision. Just being around other folks who shared my goals was priceless. You can learn so much from other people's questions, their struggles, their mistakes and successes. One of the crucial factors in my decision to sign up was OTA's lifetime retake policy which allows you to retake a class, for no extra charge, as many times as you like, which means you can take the same class with different instructors. I knew this was an important feature and I was proven right. I took full advantage of the retake policy and learned something new each time I retook the class. The different instructors I came across had distinct trading styles and that helped me formulate my own personal style that suited me and my personality best. The staff at the OTA locations I attended was great so it was always a pleasure to go back. Retaking classes helped me internalize the most basic but most important concepts of risk management and discipline.

Another added benefit of attending OTA is their commitment to their students' success.On more than one occasion, I was able to contact one of my instructors for additional information. Just recently, I needed to clarify something I didn't quite understand and I contacted one of my instructors, Brandon Wendell. Within hours, he responded back to me with an answer. It's a good feeling to know you have a trader of his caliber in your corner.

Sam Seiden, OTA's Director of Online Education, can often be heard saying that trading is transfer of accounts from those who don't know to those who do. If you have any experience in trading, you know that's so true. So, on which side would you rather be?

For some free (but valuable) stuff from the OTA check out: Lessons from the Pros

A Market Climbs a Wall of Worry

-----------------Weekly Summary------------------

1. S&P to retest 1150 - expected to consolidated sideways from 1150 or pullback to the 50 day MA.

2. USD - expect a pullback to 79.55-78.62 on easing concerns over Greece and a milder than expected NFP report.

3. Yen - expect to see continued weakness, especially against the Aussie and Canadian dollars.

3. Euro - may see a limited move to the up side but expected to be capped at 1.3850-1.4000

--------------------------------------------------

The S&P 500 finished the week up 34 points (3.1%) after rising six days in a row. Stocks climbed despite widespread concerns over Greece (and other "Club Med" nations), unemployment and dismal housing sales reports (new, existing, pending). But now what? well, we're about to find out. The S&P has rallied straight into it's January resistance level. A confirmed break above 1150 is needed in order to see the S&P advances to new highs. But a retest of the 1150 level is more likely to end in sideways consolidation or a pullback to the 50 day MA.

DXY - USD Due for a Pullback

We repeatedly stated here that for the dollar, the worst case scenario is a lackluster, slow economic recovery with mild inflation. That is to say, a scenario in which risk levels are contained, but so are rate hike expectations. Last Friday's NFP number, although better than expected, was still negative. It was exactly the kind of "less worse" reading that is negative for the USD - enough to dissipate some fear, but not strong enough to invoke serious thought about interest rate increases.

Technically, the dollars bull run that started late in 2009 seems ready for a pullback. We should expect a pullback to at least 79.55 (10 day EMA) or 78.62 (38.2% retracement). A record number of short positions against the euro and GBP created the perfect set up for a short squeeze in either or both currencies. Any positive news coming out of either the UK, the EU or both, should prove negative for the US dollar, at least in the short term.

1. S&P to retest 1150 - expected to consolidated sideways from 1150 or pullback to the 50 day MA.

2. USD - expect a pullback to 79.55-78.62 on easing concerns over Greece and a milder than expected NFP report.

3. Yen - expect to see continued weakness, especially against the Aussie and Canadian dollars.

3. Euro - may see a limited move to the up side but expected to be capped at 1.3850-1.4000

--------------------------------------------------

The S&P 500 finished the week up 34 points (3.1%) after rising six days in a row. Stocks climbed despite widespread concerns over Greece (and other "Club Med" nations), unemployment and dismal housing sales reports (new, existing, pending). But now what? well, we're about to find out. The S&P has rallied straight into it's January resistance level. A confirmed break above 1150 is needed in order to see the S&P advances to new highs. But a retest of the 1150 level is more likely to end in sideways consolidation or a pullback to the 50 day MA.

DXY - USD Due for a Pullback

We repeatedly stated here that for the dollar, the worst case scenario is a lackluster, slow economic recovery with mild inflation. That is to say, a scenario in which risk levels are contained, but so are rate hike expectations. Last Friday's NFP number, although better than expected, was still negative. It was exactly the kind of "less worse" reading that is negative for the USD - enough to dissipate some fear, but not strong enough to invoke serious thought about interest rate increases.

Technically, the dollars bull run that started late in 2009 seems ready for a pullback. We should expect a pullback to at least 79.55 (10 day EMA) or 78.62 (38.2% retracement). A record number of short positions against the euro and GBP created the perfect set up for a short squeeze in either or both currencies. Any positive news coming out of either the UK, the EU or both, should prove negative for the US dollar, at least in the short term.

Japanese Yen

As usual, the biggest loser in a "risk on" environment is the Yen. The Japanese currency has several good fundamental reasons to weaken. You can check out Marc Chandler's blog for more information. If risk appetite prevails, and we see the market continuing to fade bad news, we can expect the yen to continue to weaken, especially against the loonie and Aussie.

Euro - licking the wounds

The Euro may finally get a few days of rest to lick its wounds as tensions over Greece ease a bit. But look at the following headline:

Sounds familiar, right? But consider this: the story is dated January 14th 2009 - more than one year ago! so what is my point? the point is that sovereign debt issues cannot and will not be resolved over night. It took months for the Greek crisis to peak but it was already well in play by early 2009. We can only assume that Dubai, California, and more relevant to the euro, Spain, Portugal, Italy, and Ireland will continue to dominate the headlines with a fresh supply of debt crises. Sovereign debt problems in the EU have had a more severe affect on the single currency due to the political and financial complexity of the EU. Neither German nor French citizens want to see their tax euros used to bailout Greece - and this is causing extra pressure on Merkel and Sarkozy. However, they cannot leave Greece completely neglected as inaction will undoubtedly increase the risk of contagion. The point is, again, there is no simple solution and euro rallies will be subjected to selling pressure. We should expect to see any upward moves capped at 1.3850-1.4000 level.

Sunday, March 7, 2010

Commitment of Traders (COT) Reports - 03/02/2010

New Commitment of Traders (COT) graphs. This is the March 5th report (data as of Tuesday, March 2nd). Graphs display net positions for Commercials, non-Commercials, and non-Reportable traders.

CLICK ON THE GRAPHS TO ENLARGE

S&P 500 (e-mini) COT Report

Not surprisingly (considering a six-day winning streak for stocks), the e-mini's net positions graph still looks bullish. The levels of Commercial net long positions have not been seen since March of 09. The elevated levels of net long positions have been sustained now for four weeks straight. A retest of 1150 on the S&P seems almost inevitable at this point.

US Dollar Index (DXY) COT Report

Commercials' net long positions are still in extreme positive territory. It's very interesting to note a positive correlation between the dollar and the S&P continues to develop. When you think about it, it makes sense: the Fed seems much closer to invoking its exit strategy sequence than either the ECB or the BOE. And while US recovery is still spotty at best, the EU and the UK are plagued with political and financial problems that put both in a disadvantageous position relative to the US.

Euro COT Report

Net short levels for the single currency are still at extreme levels, though slightly less so this week. Remember, by Monday, this information will already be week old - any positive news coming out of the EU will produce a nice short squeeze for the euro.

British Pound (GBP) COT Report

No other way to put - the pound is getting pounded. It even performed worse than the euro. how about that?

no wonder then, to see a record net short positions against the GBP.

Australian Dollar (AUD) COT Report

RBA raised rates earlier this week. The move was largely anticipated and the Aussie showed little to no gains immediately following the RBA's announcement. However, the interest rate differential has increased which should get some would be carry traders drooling. It is highly likely that the slightest easing of sovereign debt concerns will send the Aussie higher, especially against the non yielding yen.

Canadian Dollar (CAD) COT Report

Without a doubt, the loonie has been one of the best performing currencies against the strong US dollar and Japanese yen.

Japanese Yen (JPY) COT Report

Surprising spike in net long for commercials. Again, we have to take into account that this report reflects positions as of last Tuesday, i.e. before the successful Greek bond offering and better than expected US NFP report.

CLICK ON THE GRAPHS TO ENLARGE

S&P 500 (e-mini) COT Report

Not surprisingly (considering a six-day winning streak for stocks), the e-mini's net positions graph still looks bullish. The levels of Commercial net long positions have not been seen since March of 09. The elevated levels of net long positions have been sustained now for four weeks straight. A retest of 1150 on the S&P seems almost inevitable at this point.

US Dollar Index (DXY) COT Report

Commercials' net long positions are still in extreme positive territory. It's very interesting to note a positive correlation between the dollar and the S&P continues to develop. When you think about it, it makes sense: the Fed seems much closer to invoking its exit strategy sequence than either the ECB or the BOE. And while US recovery is still spotty at best, the EU and the UK are plagued with political and financial problems that put both in a disadvantageous position relative to the US.

Euro COT Report

Net short levels for the single currency are still at extreme levels, though slightly less so this week. Remember, by Monday, this information will already be week old - any positive news coming out of the EU will produce a nice short squeeze for the euro.

British Pound (GBP) COT Report

No other way to put - the pound is getting pounded. It even performed worse than the euro. how about that?

no wonder then, to see a record net short positions against the GBP.

Australian Dollar (AUD) COT Report

RBA raised rates earlier this week. The move was largely anticipated and the Aussie showed little to no gains immediately following the RBA's announcement. However, the interest rate differential has increased which should get some would be carry traders drooling. It is highly likely that the slightest easing of sovereign debt concerns will send the Aussie higher, especially against the non yielding yen.

Canadian Dollar (CAD) COT Report

Without a doubt, the loonie has been one of the best performing currencies against the strong US dollar and Japanese yen.

Japanese Yen (JPY) COT Report

Surprising spike in net long for commercials. Again, we have to take into account that this report reflects positions as of last Tuesday, i.e. before the successful Greek bond offering and better than expected US NFP report.

Greece - a Trial by Ordeal

Wikipedia describes trial by ordeal as:

The last round of meetings between the Greek PM and his German and French counterparts yielded more of the same. A pledge to help if and when needed but no actual details or concrete commitments. Nonetheless, there seems to be a growing realization that the EU must step up if it wants to survive. Failure to help Greece would, no doubt, exacerbate the already severe financial conditions faced by Spain and Portugal expose them to lethal market speculations that will, in a self-fulfilling prophesy, increase their debt costs to painful levels.

"...a judicial practice by which the guilt or innocence of the accused is determined by subjecting them to a unpleasant, usually dangerous experience."Practice of trial by ordeal was prevalent in medieval Europe and one common ordeal was Ordeal of Cold Water in which an accused was submerged and proven innocent if he or she sank. Again, from Wikipedia:

"Ordeal by water was later associated with the witch-hunts of the 16th and 17th centuries.....an accused who sank (and usually drowned) was considered innocent, while floating indicated witchcraft."Following the recent developments in Europe concerning Greece, one cannot help getting a sense that Greece is being tried by "ordeal of cold water". Drowning in its own debt, Greece was left to sink or swim as Europe's "high clergy" (Germany, France) watched from the sidelines, pledging to save Greece, if it actually sank to the edge of financial death.

The last round of meetings between the Greek PM and his German and French counterparts yielded more of the same. A pledge to help if and when needed but no actual details or concrete commitments. Nonetheless, there seems to be a growing realization that the EU must step up if it wants to survive. Failure to help Greece would, no doubt, exacerbate the already severe financial conditions faced by Spain and Portugal expose them to lethal market speculations that will, in a self-fulfilling prophesy, increase their debt costs to painful levels.

Thursday, March 4, 2010

Wild Card Friday

The S&P 500 has been trading in a narrow, 10 point range (1116-1125) since Tuesday. For the most part, the stock market has treated both good and bad economic reports with the same indifference. But Friday promises to end the week with a crescendo: US non-farm payroll report. The results of the much anticipated report and its subsequent interpretation are anyone's guess. Wednesday ADP report showed a loss of about 20,000 jobs in February, definitely not a good number but in line with a declining trend of job cuts. The NFP, which is calculated differently than ADP's, is expected to be adversely impacted by February's snow storms.

The S&P's daily chart looks bullish and a retest of January's 1150 high seems closer than ever. Still, signs of risk aversion are apparent, most notably in a stronger yen.

There are 3 possible outcomes for tomorrow's NFP report:

1. Inline with expectations -should be positive for the stock market but potentially damaging to the US dollar and yen.

2. Better than expected - should, obviously, be positive for the stock market and negative for the yen. A slightly better NFP number could prove negative for the dollar while a much better than expected could lift the dollar higher (recall Dec 4 2008 NFP report).

3. Worse than expected - a slightly worse than expected report is somewhat anticipated and is already factored in. So if the number is only slightly worst than expected, the market might breath a sigh of relief and charge forward. In this case both the yen and the US dollar might pair gains. Having said that, a MUCH worse than expected will surely be negative for the stock market and support stronger US dollar and yen.

Another Friday wild card, with a potential for an upside surprise, is the Papandreou/Merkel meeting. The German Chancellor was quick to point out the meeting was largely symbolic in nature and not intended to discuss a possible bailout for Greece. Still, we should expected them to come out with some reassuring statements regarding the strength of the EU and its resolve to stick together in tough times.

In short, it's almost impossible to predict what will happen tomorrow. One thing for sure, it will not be boring!

The S&P's daily chart looks bullish and a retest of January's 1150 high seems closer than ever. Still, signs of risk aversion are apparent, most notably in a stronger yen.

There are 3 possible outcomes for tomorrow's NFP report:

1. Inline with expectations -should be positive for the stock market but potentially damaging to the US dollar and yen.

2. Better than expected - should, obviously, be positive for the stock market and negative for the yen. A slightly better NFP number could prove negative for the dollar while a much better than expected could lift the dollar higher (recall Dec 4 2008 NFP report).

3. Worse than expected - a slightly worse than expected report is somewhat anticipated and is already factored in. So if the number is only slightly worst than expected, the market might breath a sigh of relief and charge forward. In this case both the yen and the US dollar might pair gains. Having said that, a MUCH worse than expected will surely be negative for the stock market and support stronger US dollar and yen.

Another Friday wild card, with a potential for an upside surprise, is the Papandreou/Merkel meeting. The German Chancellor was quick to point out the meeting was largely symbolic in nature and not intended to discuss a possible bailout for Greece. Still, we should expected them to come out with some reassuring statements regarding the strength of the EU and its resolve to stick together in tough times.

In short, it's almost impossible to predict what will happen tomorrow. One thing for sure, it will not be boring!

Tuesday, March 2, 2010

S&P Closes (slightly) Up - but Yen Says, Fear is Here

The S&P started the week with a strong move up, closing above its 50 day MA for the first time in over a month. Tuesday morning saw a strong opening for stocks but weakness emerged toward the closing. As we mentioned in the weekly review on Saturday, yen strength is a red flag. Hopefully, the S&P will move higher and the red flag will turn out to be nothing more than a red herring but for now we must to stay vigilant The yen's strength today was evident not only against the battered euro and British pound but also against the strong USD, the loonie, and the Aussie dollar.

It's too early to say if the relatively strong yen is meaningful but we have to remember that in the past, it's been a bad omen for the markets. You might recall the days preceding the Dubai debt crisis in late Nov. 2009. In the days BEFORE Dubai hit the headlines, the yen soared with no apparent reason. Perhaps traders are betting on a weak ADP report on Wednesday morning. That would not be a complete surprise as recent news suggests. Or perhaps, more bad news from the EU or the UK is bubbling to the surface. And then again, it could be just a temporary state of nervousness as the S&P approaches a major resistance. Whatever the case maybe, we must not ignore the sign. Keep you stops tight!