Last week was a busy one for financial markets in general and FX markets in particular. The dollar staged another advance across the board and the DXY notched a new high. The euro broke to new lows and the British pound remained under pressure. Yen lost ground across the board as stocks continued to rise alongside yield differentials.

One of the most important and most interesting developments is the rise in Treasury yields, esp. the 10 Yr notes. There are at least two relevant questions to be asked: What is driving the yields? and what are the possible effects. One possible explanation for the yield rise is that the market is pricing in a continued recovery which will, eventually, contribute to rising interest rates. Another possible explanation is that buyers of treasuries are simply bloated. With growing deficits (trade and budget) a huge supply of notes, and concerns over the future of US credit rating, the market may simply be asking for a higher risk premium to hold US debt. In either scenario, the short term expectation is bullish for the dollar.

Greece is expected to issue new bonds this week. The result of this auction will be telling and we will get a better idea as to whether or not the market puts any stock in the recently announce rescue deal for Greece.Either way, we should still expect euro rallies to serve traders as opportunities to reload their shorts rather than a trend reversal. Same goes for the British pound.

Yen was weaker across the board and this is expected to continue as long as we don't get into risk aversion mode. I have been using the S&P 500 as one measure of risk appetite and for the time being, it seems due for a pullback. I know I have been cautious since the middle of March and I also realize the danger in adopting a bearish bias - the more time passes, the more liable I am to become entrenched in my position, waiting for a correction which may only come much, much later. Having said that, I still maintain my view that a short term pullback in the stock market is immanent and may have already started last week. The market climbed a wall of worry and it will descend a wall of reassurance. This is how the game is played. The S&P COT report also shows large speculators being net short for the first time in month - another red flag. The only positive for stocks at this time are the rising yields in bonds. If bonds loose their luster because the marker is pricing in a sustained recovery, we may witness a major capital reallocation from bonds to higher yielding assets like stocks and commodities.

Traveling today so no charts with this post.

Showing posts with label EUR. Show all posts

Showing posts with label EUR. Show all posts

Sunday, March 28, 2010

Friday, March 26, 2010

Rising Yields Cement Dollar's New Highs

Positive developments yesterday (Thursday) sent stocks and the USD higher. While stocks gave up their gains during the last hour of trading, the dollar remained strong. The greenback gained against all its major counterparts, including the commodity currencies, aided by rising Treasury yields. Here's a quick recap of yesterday's news:

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

- Unemployment numbers came in slightly better than expected.

- Strong earnings/guidance from Best Buy and Qualcomm.

- Citi gained on news suggesting the Treasury will unveil a plan to sell its stake in the bank.

- Bernanke gave the market another fix of its favorite drug - commitment to keeping easy, cheap money flowing.

- France, Germany find common grounds for Greece assistance package involving the IMF (but euro makes new lows)

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

Sunday, March 7, 2010

Greece - a Trial by Ordeal

Wikipedia describes trial by ordeal as:

The last round of meetings between the Greek PM and his German and French counterparts yielded more of the same. A pledge to help if and when needed but no actual details or concrete commitments. Nonetheless, there seems to be a growing realization that the EU must step up if it wants to survive. Failure to help Greece would, no doubt, exacerbate the already severe financial conditions faced by Spain and Portugal expose them to lethal market speculations that will, in a self-fulfilling prophesy, increase their debt costs to painful levels.

"...a judicial practice by which the guilt or innocence of the accused is determined by subjecting them to a unpleasant, usually dangerous experience."Practice of trial by ordeal was prevalent in medieval Europe and one common ordeal was Ordeal of Cold Water in which an accused was submerged and proven innocent if he or she sank. Again, from Wikipedia:

"Ordeal by water was later associated with the witch-hunts of the 16th and 17th centuries.....an accused who sank (and usually drowned) was considered innocent, while floating indicated witchcraft."Following the recent developments in Europe concerning Greece, one cannot help getting a sense that Greece is being tried by "ordeal of cold water". Drowning in its own debt, Greece was left to sink or swim as Europe's "high clergy" (Germany, France) watched from the sidelines, pledging to save Greece, if it actually sank to the edge of financial death.

The last round of meetings between the Greek PM and his German and French counterparts yielded more of the same. A pledge to help if and when needed but no actual details or concrete commitments. Nonetheless, there seems to be a growing realization that the EU must step up if it wants to survive. Failure to help Greece would, no doubt, exacerbate the already severe financial conditions faced by Spain and Portugal expose them to lethal market speculations that will, in a self-fulfilling prophesy, increase their debt costs to painful levels.

Saturday, February 27, 2010

What Bad News?

Weekly Summary:

1. S&P - uptrend still intact but under pressure (note recent yen strength, weak economic reports).

2. USD - DXY showing signs of fatigue as it struggles in its current congestion level. Expect further sideways consolidation with chances for a limited down move.

4. Euro and GBP - continue to be under pressure. Even if we get to see some USD and/or yen weakness, euro and GBP gains expected to be limited.

5. In case we get a break to the upside on the S&P, the Aussie and Canadian dollars stand the most to gain, especially against the Japanese yen.

------------------------------------------------------------

Despite ending the week five and a half points lower, the S&P, in an act of defiance, faded one piece of bad news after another. And they just kept on coming - consumer confidence, new home sales, core durable goods orders, unemployment claims, existing home sales - all came in worse than expected. And let's not forget Greece! Yet despite the barrage of negative economic readings and contrary to reason, the S&P managed to erase most of its losses for the week. The S&P's tight range indicates a market searching for direction while evidence of buying pressure indicates the higher probability direction is still up. Market veterans are often quoted saying that when the market is going up for no apparent reason, don't try to fight it. It's the "don't-catch-a-falling-knife" logic - only in reverse.

What's Wrong With This Picture?

I think the image below captures the market's lack of direction perfectly. Look at the head line - future fall as investors remain cautious about consumer led recovery. Yet right underneath we see that Target's profit rises 53.7%, Sears' profit more than doubles, and Home Depot beats estimates. Not too shabby.

Yen Strength - Still a Red Flag

The Japanese yen has been one of the best fear indicators in recent months. Therefore we must take note of the fact that many yen pairs slid to levels not seen since Feb 5th - the recent S&P low. In fact, Euro/Yen and Pound/Yen made fresh lows. The recent yen strength is indicative of risk aversion but the recent COT report shows that traders commitment for supporting a stronger yen is weakening. If that happens, we can expect to see a strong recovery of AUDJPY and CADJPY and a more modest one for EURJPY and GBPJPY. However if the yen continues to strengthen, we can certainly expect to hear comments from the BoJ about it and hints of interventions will once again resurface, curbing further yen advances.

British Pound - an Untold Story

Hidden in the shadows of the EU, Greece, and the euro, the British pound quietly but surely slid to new lows against its major counterparts. It has even lost ground against the embattled euro. Concerns over the UK's recovery and the possible need for further QE, combined with a looming general election and dovish statements by the BOE have sent the GBP on a downward spiral with no end in sight. As overextended as it may seem, we must not catch this falling knife as most analysts see further loses ahead. We are staying bearish on the pound.

Euro - Greece, the Never Ending Story

Last week we concluded that Greece will reemerge to take center stage after falling off the radar for a few short days. As expected, it did. Once again, the mess looks too big to overcome and renewed doubts over the fate of the EU resurfaced in force. We have to stay bearish on the euro at this point. Counter-trend moves are to be expected considering the record short positions but they will be short lived and capped below 1.38

DXY - Uptrend Showing Signs of Fatigue

Weekly chart for the USD reveals an inside bar for the week of Feb 22-26. This could signal further pause for the dollar's rally. Sideways action with limited moves to the downside are to be expected at this point:

1. S&P - uptrend still intact but under pressure (note recent yen strength, weak economic reports).

2. USD - DXY showing signs of fatigue as it struggles in its current congestion level. Expect further sideways consolidation with chances for a limited down move.

4. Euro and GBP - continue to be under pressure. Even if we get to see some USD and/or yen weakness, euro and GBP gains expected to be limited.

5. In case we get a break to the upside on the S&P, the Aussie and Canadian dollars stand the most to gain, especially against the Japanese yen.

------------------------------------------------------------

Despite ending the week five and a half points lower, the S&P, in an act of defiance, faded one piece of bad news after another. And they just kept on coming - consumer confidence, new home sales, core durable goods orders, unemployment claims, existing home sales - all came in worse than expected. And let's not forget Greece! Yet despite the barrage of negative economic readings and contrary to reason, the S&P managed to erase most of its losses for the week. The S&P's tight range indicates a market searching for direction while evidence of buying pressure indicates the higher probability direction is still up. Market veterans are often quoted saying that when the market is going up for no apparent reason, don't try to fight it. It's the "don't-catch-a-falling-knife" logic - only in reverse.

What's Wrong With This Picture?

I think the image below captures the market's lack of direction perfectly. Look at the head line - future fall as investors remain cautious about consumer led recovery. Yet right underneath we see that Target's profit rises 53.7%, Sears' profit more than doubles, and Home Depot beats estimates. Not too shabby.

Yen Strength - Still a Red Flag

The Japanese yen has been one of the best fear indicators in recent months. Therefore we must take note of the fact that many yen pairs slid to levels not seen since Feb 5th - the recent S&P low. In fact, Euro/Yen and Pound/Yen made fresh lows. The recent yen strength is indicative of risk aversion but the recent COT report shows that traders commitment for supporting a stronger yen is weakening. If that happens, we can expect to see a strong recovery of AUDJPY and CADJPY and a more modest one for EURJPY and GBPJPY. However if the yen continues to strengthen, we can certainly expect to hear comments from the BoJ about it and hints of interventions will once again resurface, curbing further yen advances.

British Pound - an Untold Story

Hidden in the shadows of the EU, Greece, and the euro, the British pound quietly but surely slid to new lows against its major counterparts. It has even lost ground against the embattled euro. Concerns over the UK's recovery and the possible need for further QE, combined with a looming general election and dovish statements by the BOE have sent the GBP on a downward spiral with no end in sight. As overextended as it may seem, we must not catch this falling knife as most analysts see further loses ahead. We are staying bearish on the pound.

Euro - Greece, the Never Ending Story

Last week we concluded that Greece will reemerge to take center stage after falling off the radar for a few short days. As expected, it did. Once again, the mess looks too big to overcome and renewed doubts over the fate of the EU resurfaced in force. We have to stay bearish on the euro at this point. Counter-trend moves are to be expected considering the record short positions but they will be short lived and capped below 1.38

DXY - Uptrend Showing Signs of Fatigue

Weekly chart for the USD reveals an inside bar for the week of Feb 22-26. This could signal further pause for the dollar's rally. Sideways action with limited moves to the downside are to be expected at this point:

Wednesday, February 24, 2010

New Home Sales Drop to a Record Low But Market Cries "Bull"

Despite a dismal number of new home sales in January, the stock market managed to stage a bounce after a two day decline (with 3 hours until closing bell, this could still change). The rise in stocks is largely attributed to Bernanke's congressional testimony in which he reiterated the need for zero rate policy for an "extended" period. In addition to the gains in stocks, we see the dollar and the yen hold on to most of their recent gains. So what does it all mean?

- Equities - the market's muted reaction to the new home sales report is very bullish but it must be taken in context, namely, zero rate policy. For sure, cheap money supply has supported the recovery efforts. But it also had the undesirable affect of carry trades. We should not think of carry trade just in the sense of using dollars to buy other currencies. Instead, think of it in a broader sense where cheap US dollars are used to fund any number of riskier assets like stocks, bonds, real-estate, etc. Basically, with a zero rate policy, one has no incentive to keep one's money in the form of (depreciating) cash. The stock market is showing clear signs of severe addiction to zero interest rates. We are sure to experience some sobering days in the future when the economy checks into rehab.

- Strong dollar - How is it possible for the dollar and the stock market to rally at the same time? the answer, to a great extent, is the way we measure dollar strength, namely, the dollar index. The dollar index is a weighted index which tracks the dollar's strength against a basket of currencies, of which the euro alone accounts for more than 57% and the combination of euro+pound+yen accounts for more than 80%. This means that it's enough for the dollar to show strength against the euro and British pound in order to send the DXY higher. And there's good reason for the dollar's strength vs. the euro and the pound. While Bernanke is laying out his exit plans, the UK and the EU are knee deep in trouble with no end in sight to loose monetary policy.

- Strong yen - We are used to seeing a strong inverse-correlation between yen pairs and equities. When equities rise, yen eases (risk on) and when the stock market falls we normally see the yen rise (risk off). So it is important to note here that while stocks nearly regained their highs for the week, the yen stayed relatively strong, relenting only some of its recent gains. This price action is indicative of a shaky market sentiment.

Thursday, February 18, 2010

Euro to Test SNB's Resolve

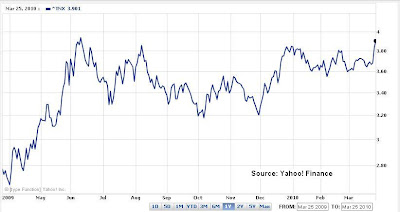

The SNB's message over the past months has been consistent - it will fight a stronger Swiss franc. But the market proved to be a mighty adversary for the SNB. Since the EURCHF broke the 1.5 level on 12/18/2009, the SNB attempts for intervention (see chart) were met with massive opposition.

As the EURCHF once again approaches "intervention territory", it remains to be seen whether the SNB will take another shot at intervention or if it finally decided that fighting a weaker euro is a lost cause.

The Chart below points out recent intervention attempts:

-forexRoy

As the EURCHF once again approaches "intervention territory", it remains to be seen whether the SNB will take another shot at intervention or if it finally decided that fighting a weaker euro is a lost cause.

The Chart below points out recent intervention attempts:

-forexRoy

Tuesday, February 16, 2010

Dubai Reminds Us What Greece Would Like Us to Forget

Renewed concerns regarding Dubai's debt remind us what we need to remember about Greece and the EU - a quick fix is not going to make the problem go away. On a day we see a 20 point rally on the S&P, and the dollar and yen receding, it is tempting to think that the worst of Greece is behind us. But then Dubai reminds us - not so fast..... First, the S&P is rallying straight into a resistance level at 1100. Even if it manages to break this resistance, it still has to retest a much stronger resistance at 1150, so let's hold the celebrations (See chart below). Second, let's be aware of our human nature - we like to see that glass half full.

As humans we have been blessed with a short, selective memory. This unique feature helps us surmount life's most excruciating . Individuals and societies alike are programmed to leave behind painful memories and march forward toward a better future. This mechanism can help us overcome personal or national tragedies. Unfortunately, this same mechanism can also condemn us to repeat our mistakes, as we conveniently forget the undesirable consequences of our actions. So what can we do? we need to stick to the facts and not trade on "hope". Remember that markets reflect expectations and not necessarily current, underlying conditions. As such, markets can fluctuate wildly as expectations change but fundamentals remain more or less the same.

As humans we have been blessed with a short, selective memory. This unique feature helps us surmount life's most excruciating . Individuals and societies alike are programmed to leave behind painful memories and march forward toward a better future. This mechanism can help us overcome personal or national tragedies. Unfortunately, this same mechanism can also condemn us to repeat our mistakes, as we conveniently forget the undesirable consequences of our actions. So what can we do? we need to stick to the facts and not trade on "hope". Remember that markets reflect expectations and not necessarily current, underlying conditions. As such, markets can fluctuate wildly as expectations change but fundamentals remain more or less the same.

Sunday, January 24, 2010

USD Index Notches a New High

Last week, we covered the USD and concluded it was poised for gains. The Dollar did, in fact, gain against most of its major counterparts and the DXY notched a new high, breaking slightly above its December highs. The DXY is a weighted average and its heaviest component is the Euro. Therefore it should come as no surprise that the previous week was rather rough on the common currency. Greece is still very much in the news and not in a good way, dragging the Euro lower.

Last week's post mentioned that the USD was a win/win situation where either strong economic reports or very poor readings could send the dollar higher on expectations for higher interest rates or a flight to safety respectively. Unfortunately, it was a flight to safety that sent the dollar higher. So long as uncertainly and concerns cloud the economic skies, we are likely to see the USD trend higher. This week, however, the dollar will have to push a little harder to be able to maintain its momentum as it approaches new resistance levels. The first resistance level is right where the dollar made its new high on Thursday around 78.80-79.00. The next level the USD will need to overcome in order to march higher is 79.50. A clear break above the 79.50 level could send the dollar as high as 81.00.

An upward move for the USD this week is likely, though not as likely as it was last week. The higher probability is for some sideways consolidation while uncertainties in the economy clear and earning reports shed more light on the state of affairs.

Last week's post mentioned that the USD was a win/win situation where either strong economic reports or very poor readings could send the dollar higher on expectations for higher interest rates or a flight to safety respectively. Unfortunately, it was a flight to safety that sent the dollar higher. So long as uncertainly and concerns cloud the economic skies, we are likely to see the USD trend higher. This week, however, the dollar will have to push a little harder to be able to maintain its momentum as it approaches new resistance levels. The first resistance level is right where the dollar made its new high on Thursday around 78.80-79.00. The next level the USD will need to overcome in order to march higher is 79.50. A clear break above the 79.50 level could send the dollar as high as 81.00.

An upward move for the USD this week is likely, though not as likely as it was last week. The higher probability is for some sideways consolidation while uncertainties in the economy clear and earning reports shed more light on the state of affairs.

Sunday, January 17, 2010

USD Poised for Gains in the Week Ahead

While the US dollar index (DXY) retraced some of its December gains, it is still noticeably stronger than it was in the beginning of December 2009. Here are some signs we may see the dollar index advance in the coming week:

1. DXY failed twice to close below its 10 Week EMA:

2. Retracement in the DXY has been relatively shallow, finding support around the 38.2% level - suggesting the uptrend may resume from here:

3. USDCAD, USDCHF trade near weekly/daily support levels while AUDUSD is near a major daily resistance level. GBPUSD and EURUSD also look bearish in the short term. All suggesting we may see further strengthening in the US dollar.

4. Fundamental backdrop: last week's key earning reports disappointed. Alcoa's numbers failed to impress and JP Morgan, while profitable, signaled problems in consumer credit delinquencies that sent the broad market lower. The disappointing earnings coupled with concerns over China's attempts to slow down its booming economy provided a convenient argument for traders to shy away from "risky", higher-yielding currencies in favor of US dollar and Yen's relative safety.

As I mentioned several times in the past, there are two favorable scenarios for the dollar: strong, sustained recovery or, quite the opposite, the return of fear into the markets. Somewhere between the two lies the worst case scenario for the dollar - a long, sluggish, jobless recovery and a stagnant US economy - the perfect conditions for the Fed to maintain low interest rates and loose monetary policies.

When the DXY climbs, Dollar/Yen ratio will usually serve as a good barometer as too which one of the scenarios above is playing out. Expectation for strong US growth will normally send USDJPY higher, while return of fear into the market will cause the dollar to gain strength against most currencies but the Yen, sending the Dollar/Yen pair lower.

1. DXY failed twice to close below its 10 Week EMA:

2. Retracement in the DXY has been relatively shallow, finding support around the 38.2% level - suggesting the uptrend may resume from here:

3. USDCAD, USDCHF trade near weekly/daily support levels while AUDUSD is near a major daily resistance level. GBPUSD and EURUSD also look bearish in the short term. All suggesting we may see further strengthening in the US dollar.

4. Fundamental backdrop: last week's key earning reports disappointed. Alcoa's numbers failed to impress and JP Morgan, while profitable, signaled problems in consumer credit delinquencies that sent the broad market lower. The disappointing earnings coupled with concerns over China's attempts to slow down its booming economy provided a convenient argument for traders to shy away from "risky", higher-yielding currencies in favor of US dollar and Yen's relative safety.

As I mentioned several times in the past, there are two favorable scenarios for the dollar: strong, sustained recovery or, quite the opposite, the return of fear into the markets. Somewhere between the two lies the worst case scenario for the dollar - a long, sluggish, jobless recovery and a stagnant US economy - the perfect conditions for the Fed to maintain low interest rates and loose monetary policies.

When the DXY climbs, Dollar/Yen ratio will usually serve as a good barometer as too which one of the scenarios above is playing out. Expectation for strong US growth will normally send USDJPY higher, while return of fear into the market will cause the dollar to gain strength against most currencies but the Yen, sending the Dollar/Yen pair lower.

Friday, January 8, 2010

As One Year Ends, a New Decade Begins

Well, I guess this is kind of a heavy title but we are starting a new year and a new decade and what better way to usher them in than with the my first post for 2010! I avoided posting anything in the last two weeks of 2009 mainly because of holiday mood but also because volume was so thin across the board, leading to spikes and extreme moves which did not contribute to a clear direction in the markets.

I figured now would be a great time to take a little survey of the major currencies and take our first baseline for the year. Before we look into individual currencies, it is important to note a major theme that emerged in the final weeks of 2009 and set the stage for 2010. The theme I am talking about is relativity. For the better part of 2009, the major currencies traded in tandem vs. the US dollar with a high degree of correlation. When the Euro appreciated against the dollar, so did the British pound, and the Canadian loonie (Yen was the exception to this rule). Gradually, however, as signs of a global recovery became more evident, some currencies emerged much stronger than others, exhibiting their relative strength against others. The competition in the world of currencies shifted from the "best of the worst" to an arena where clear winners emerged - the "best and the rest" if you will. As the GBP and EUR slid against the dollar in December 2009, the Australian and Canadian dollars kept a much firmer stance, quickly recovering most of their loses against the USD. This could be another sign of normalization. As the recovery takes hold, investors focus more on the fundamentals of the different economies and on interest rate expectations, rather then pure risk on/off trades. With that in mind, let's take a look are where the majors stand. First, the US dollar.

USD - Cautiously Bullish in the Short Term

George Soros said it best in early 2009 when he called the dollar the "fever chart" of the economy. And indeed up until December 09 as the economy got less worse, the dollar ("fever") declined. News and economic reading that came in better than expected actually pushed the dollar lower as risk aversion became less pronounced. That was the trend until December 4th, when a non-Farm Payroll report came in much better than expected, sending the dollar on a four-week rally and revealing a shift of focus from risk of a lingering and deep recession to the inevitability of interest rate increases.

Both Economist and traders differ in their predictions for when the Fed might start hiking rates but all agree it will not happen before the middle of 2010, at the very earliest. One other certainty is that the Fed will be under significant political pressure to keep rates low due to massive unemployment figures.

The NFP numbers released today, January 08 2010, and the market reaction that followed their release illuminated both the dollar's sensitivity to interest rates factors and the lingering bullish sentiment for the US dollar.

The NFP numbers came in much worse than expected, exactly the opposite surprise we got one month ago. The reading sent both S&P futures and the dollar down sharply but the losses were brief and mostly erased in a very short time as the market faded the news. Another bullish sign for the dollar is its ability to hang on to most of its December gains even as stock markets hit fresh monthly highs. It seems that the dollar is in a win-win situation: good news supporting the case for a rate hike will send the dollar higher and bad news supporting a double-dip recession will send the dollar higher in a flight to safety. Of course, this assumption also suggests that the dollar will slump in a sluggish recovery where neither rate hikes nor a double-dip recession are on the horizon.

For the time being, the dollar is still showing signs of strength and a daily chart suggests it may be ready to break out of (or completely fail) a bullish flag:

Euro - the Fallen Star

For most of the first decade of the new millennium, the Euro has been on a meteoric rise against the dollar, climbing more than sixty per cent vs the greenback between 2000-2008. Who can forget the public denunciation and humiliation of the dollar as Her Royal Hotness, Gisele, made it loud and clear she was to be paid in Euros. Alas, even the richest Supermodel on the planet could not have foreseen the looming crash ignited by the sub-prime disaster. The global recession wreaked havoc across the Euro Zone and exposing cracks in Gisele's logic. Fighting its very first battle against a major economic storm, the Euro Zone faces unique challenges that set the stage as we enter 2010. The theme for the Euro Zone as we enter the new decade is fragmentation. While one can argue that the EU and the US share many similarities with respect to the Great Recession, it has become more and more evident that fragmentation and disparities in the Euro Zone's economies are a much bigger problem (or at least perceived this way) than they are in the USA. For example, one can argue that California and Michigan are to the US what Greece and Spain are to the EU. But in the market's eyes, this is not the case. The political diversification and distributed nature of the Euro Zone economy pose a much bigger challenge.

The Euro is starting 2010 after being severely punished late 2009 for the Greek debt downgrade and lingering concerns about the quality and cohesiveness of the European recovery. Grave concerns regarding East European debt remain in the minds of investors. And the ECB will face tough decisions ahead as a strong German recovery warrants interest rate hikes while much worse conditions elsewhere in the Euro Zone will make rate hikes very tricky. At the close of the first trading week of the year, the Euro is near weekly low levels vs the dollar, monthly lows against the Swiss franc, and is at yearly lows against the Aussie dollar. We should expect to see somewhat of a bounce at this long-term demand levels but fundamentally speaking, the Euro is still out of favor until we hear a more hawkish tone from Mr. JC Trichet.

Key levels to watch for the Euro are the 200 day MA for the EURUSD and a break below the 1.5500 level on the EURAUD.

Yen - 09's Wild Card -2010's laggard

In 2009 the Japanese Yen proved to be one of the trickiest currencies to trade, defying both technical levels and fundamentals, due in part to swift and stark political changes. As we enter 2010, the Yen is probably one of the weakest of the Majors. The struggling Japanese economy, plagued by deflation, aging population and heavily reliant on exports is certain to keep its downward pressure on the Yen. The recent, surprising, appointment of a new finance minister, much more dovish than his predecessor, paves the way for further Yen weakness. Nowhere is the Yen's weakness more evident than in its relationship to the Aussie and Canadian dollar as the "carry trade" the last decade carries itself into the new decade. We can expect the Yen to trend lower this year, especially against the commodity currencies.

British Pound

The British economy is just about as miserable as any, recovering from a banking crisis, real-estate bubble, a huge deficit, and in the midst of loose monetary and fiscal policies. However, the implications for the British pound are not so clear at this moment and the GBP has been trending higher vs. the Euro and Yen in a "best of the worst" competition. It remains to be seen how soon will the UK start to remove some of the huge liquidity pumped into its economy during the crisis and move toward rate hikes. At this point, the GBP should be traded mostly on technical levels.

Aussie and Canadian dollars - Kings of the Hill

The run-up in commodities from copper to gold to oil catapulted the "commodity" currencies this year against all other currencies. The undisputed champion is, without a doubt, the Aussie dollar. Boasting some of the highest interest rates among the G20 and a major beneficiary of China's insatiable appetite and various stimuli induced projects around the world, the Australian economy dodged the Great Recession practically unscathed. The high yielding currency proves, once again, irresistibly enticing to would be carry traders and the Yen, once again, is the funding vehicle of choice. The Canadian dollar came in a close second. Boosted by high oil and record gold prices, the Canadian currency finished 2009 on a tear.

Going back to the theme of relativity it is important to note how the US dollar was unable to keep its gains against the Aussie and the Loonie while pushing the GBP and EUR to weekly lows.

From Best of the Worst to Best Vs the Rest

From what we've covered so far, it stands to reason that:

1. Gisele is still hot but Euro, not that much.

2. The best opportunities this year will probably be shorting the Yen and going long Aussie and Loonie.

3. Special attention must be paid to central banks' exit strategies, timing, and market reaction to both.

Labels:

DXY,

EUR,

Euro,

Sovereign Debt,

USD,

weekly highlights

Wednesday, December 23, 2009

Like Rain on Your Wedding Day

Alanis Morissette will probably disagree but in my opinion, rain on your wedding day is hardly ironic. It could be sad, annoying, or, in the event of an indoor wedding, a non-issue. Similarly, a fly in your chardonnay is simply off putting and in the grand scheme of things, not that big of a deal. What is ironic, however, is Greece's debt rating getting downgraded for the fourth time this year, and Greek equity and bond markets cheering the news.

Greek sovereign debt was downgraded twice this year by Fitch (Oct 22 and again Dec 08) and once by S&P (Dec 15). But it was Moody's downgrade on Dec. 22 that sent Greek markets into a "celebratory" rally. It's really all about perception: Moody's downgraded Greek debt by only one notch as opposed to the two-notch downgrade the market feared. Moody's also commented that near-term crisis is unlikely, which helped ease investors' fears.

Greek sovereign debt was downgraded twice this year by Fitch (Oct 22 and again Dec 08) and once by S&P (Dec 15). But it was Moody's downgrade on Dec. 22 that sent Greek markets into a "celebratory" rally. It's really all about perception: Moody's downgraded Greek debt by only one notch as opposed to the two-notch downgrade the market feared. Moody's also commented that near-term crisis is unlikely, which helped ease investors' fears.

Thursday, December 17, 2009

Euro, Trashed

The Euro just can't seem to get a break these days. The beleaguered currency fell out of favor, only two weeks after testing its yearly highs against the USD, following the Greek debt and credit crisis which sent shock waves across the Euro Zone and the currency markets. As storm clouds gathered over Europe, signs of accelerating recovery dominated the US market. And so, in a swift and dramatic change of perception, the USD emerged as the winner.

A shift of such magnitude and velocity in what is probably the most widely traded currency pair in the world (EURUSD) has a serious affect on all other major currencies. The USD traded considerably higher against all major counterparts. Even this year's superstar "commodity currencies" (e.g. Aussie, Loonie) finally succumbed to the dollar's powerful rise and are now trading at multi-week lows against the dollar. The sharp rise in the dollar became self propelled as it brought an end to weeks and months of USD funded carry trades which had to be covered (which, in turn, contributed to the decline in EUR and Aussie). As for the EUR, it is trading lower against most major currencies, even against the less-than-stellar Pound.

The question on everyone's mind now is how much farther does the EUR have to go? and the answer is not that simple. First, one must take into account the possibility of an exaggerated market reaction due to year-end / holiday mode. After all, fundamentally, not too much has changed in 2-3 weeks. Technically, however, the picture is a little different since major support levels for the EURUSD and major resistance levels for the DXY were easily breached in rapid succession. If we attribute at least some dislocation due to year-end dynamics, then we may expect to see some dollar weakness as early as January, especially against higher yielding currencies such as the Australian dollar. But technical levels alone, leave room for the dollar to continue rising and for the Euro to continue its decline.The next firm support for EURUSD is at 1.4200 although we may start seeing some consolidation around the current level of 1.4300.

For the Euro to get some reprieve, we would first need to see some encouraging signs from Greece and some degree of assurance that other problematic EU members (Spain, Austria) have their issues in order. Any Hawkish statements from Mr. J C Trichet, certainly won't hurt either. Other things that might give the Euro a lift are SNB intervention or the very unlikely event of a credit downgrade for the UK. One thing is for sure: it's hard to imagine anyone in the EU is terribly upset about a declining currency. A weaker Euro is a boon for European exporters and Europe's vast tourism industry.

A shift of such magnitude and velocity in what is probably the most widely traded currency pair in the world (EURUSD) has a serious affect on all other major currencies. The USD traded considerably higher against all major counterparts. Even this year's superstar "commodity currencies" (e.g. Aussie, Loonie) finally succumbed to the dollar's powerful rise and are now trading at multi-week lows against the dollar. The sharp rise in the dollar became self propelled as it brought an end to weeks and months of USD funded carry trades which had to be covered (which, in turn, contributed to the decline in EUR and Aussie). As for the EUR, it is trading lower against most major currencies, even against the less-than-stellar Pound.

The question on everyone's mind now is how much farther does the EUR have to go? and the answer is not that simple. First, one must take into account the possibility of an exaggerated market reaction due to year-end / holiday mode. After all, fundamentally, not too much has changed in 2-3 weeks. Technically, however, the picture is a little different since major support levels for the EURUSD and major resistance levels for the DXY were easily breached in rapid succession. If we attribute at least some dislocation due to year-end dynamics, then we may expect to see some dollar weakness as early as January, especially against higher yielding currencies such as the Australian dollar. But technical levels alone, leave room for the dollar to continue rising and for the Euro to continue its decline.The next firm support for EURUSD is at 1.4200 although we may start seeing some consolidation around the current level of 1.4300.

For the Euro to get some reprieve, we would first need to see some encouraging signs from Greece and some degree of assurance that other problematic EU members (Spain, Austria) have their issues in order. Any Hawkish statements from Mr. J C Trichet, certainly won't hurt either. Other things that might give the Euro a lift are SNB intervention or the very unlikely event of a credit downgrade for the UK. One thing is for sure: it's hard to imagine anyone in the EU is terribly upset about a declining currency. A weaker Euro is a boon for European exporters and Europe's vast tourism industry.

Subscribe to:

Posts (Atom)