- Unemployment numbers came in slightly better than expected.

- Strong earnings/guidance from Best Buy and Qualcomm.

- Citi gained on news suggesting the Treasury will unveil a plan to sell its stake in the bank.

- Bernanke gave the market another fix of its favorite drug - commitment to keeping easy, cheap money flowing.

- France, Germany find common grounds for Greece assistance package involving the IMF (but euro makes new lows)

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

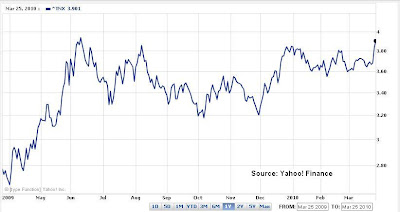

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk: