Last week was a busy one for financial markets in general and FX markets in particular. The dollar staged another advance across the board and the DXY notched a new high. The euro broke to new lows and the British pound remained under pressure. Yen lost ground across the board as stocks continued to rise alongside yield differentials.

One of the most important and most interesting developments is the rise in Treasury yields, esp. the 10 Yr notes. There are at least two relevant questions to be asked: What is driving the yields? and what are the possible effects. One possible explanation for the yield rise is that the market is pricing in a continued recovery which will, eventually, contribute to rising interest rates. Another possible explanation is that buyers of treasuries are simply bloated. With growing deficits (trade and budget) a huge supply of notes, and concerns over the future of US credit rating, the market may simply be asking for a higher risk premium to hold US debt. In either scenario, the short term expectation is bullish for the dollar.

Greece is expected to issue new bonds this week. The result of this auction will be telling and we will get a better idea as to whether or not the market puts any stock in the recently announce rescue deal for Greece.Either way, we should still expect euro rallies to serve traders as opportunities to reload their shorts rather than a trend reversal. Same goes for the British pound.

Yen was weaker across the board and this is expected to continue as long as we don't get into risk aversion mode. I have been using the S&P 500 as one measure of risk appetite and for the time being, it seems due for a pullback. I know I have been cautious since the middle of March and I also realize the danger in adopting a bearish bias - the more time passes, the more liable I am to become entrenched in my position, waiting for a correction which may only come much, much later. Having said that, I still maintain my view that a short term pullback in the stock market is immanent and may have already started last week. The market climbed a wall of worry and it will descend a wall of reassurance. This is how the game is played. The S&P COT report also shows large speculators being net short for the first time in month - another red flag. The only positive for stocks at this time are the rising yields in bonds. If bonds loose their luster because the marker is pricing in a sustained recovery, we may witness a major capital reallocation from bonds to higher yielding assets like stocks and commodities.

Traveling today so no charts with this post.

Sunday, March 28, 2010

Saturday, March 27, 2010

Commitment of Traders (COT) Reports - 03/23/10

These are the March 26 reports containing data as of 03/26/10. COT graphs below show net positions for Commercials (hedgers), Non-Commercials (large speculators), and Non Reportables (small speculators).

Highlights of this week's COT reports:

1. S&P (e-mini) COT Report - For the first time since October 2008, large speculators are net short. Interestingly, small speculator turned net positive this week for the first time in months. This divergence shows that smart money (non-commercials) and dumb money (non-reportables) are at odds. Isn't that the oldest story on Wall st? If what we are seeing is indeed real distribution -the process in which large players trim down profitable positions- the question must be asked: can the retail investor prop the market's momentum? At any rate, this is definitely a red flag!

2. USD COT Report - Extreme net long positions persist. This week's reading slightly higher than last week.

3. Euro COT Report - New selling pressure is evident in the increased net short positions.

4. GBP COT Report - Extreme bearishness persists and net short positions are at new highs.

5. Commodity Currencies - Both the Aussie and Loonie's COT reports show extreme net long positions are still sustained.

6. JPY COT Report - Net long speculative positions continue to decline.

7. As of this week, I am adding two new reports: Crude Oil and 10 Yr Notes.

CLICK TO VIEW LARGER IMAGE

Highlights of this week's COT reports:

1. S&P (e-mini) COT Report - For the first time since October 2008, large speculators are net short. Interestingly, small speculator turned net positive this week for the first time in months. This divergence shows that smart money (non-commercials) and dumb money (non-reportables) are at odds. Isn't that the oldest story on Wall st? If what we are seeing is indeed real distribution -the process in which large players trim down profitable positions- the question must be asked: can the retail investor prop the market's momentum? At any rate, this is definitely a red flag!

2. USD COT Report - Extreme net long positions persist. This week's reading slightly higher than last week.

3. Euro COT Report - New selling pressure is evident in the increased net short positions.

4. GBP COT Report - Extreme bearishness persists and net short positions are at new highs.

5. Commodity Currencies - Both the Aussie and Loonie's COT reports show extreme net long positions are still sustained.

6. JPY COT Report - Net long speculative positions continue to decline.

7. As of this week, I am adding two new reports: Crude Oil and 10 Yr Notes.

CLICK TO VIEW LARGER IMAGE

Friday, March 26, 2010

Rising Yields Cement Dollar's New Highs

Positive developments yesterday (Thursday) sent stocks and the USD higher. While stocks gave up their gains during the last hour of trading, the dollar remained strong. The greenback gained against all its major counterparts, including the commodity currencies, aided by rising Treasury yields. Here's a quick recap of yesterday's news:

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

- Unemployment numbers came in slightly better than expected.

- Strong earnings/guidance from Best Buy and Qualcomm.

- Citi gained on news suggesting the Treasury will unveil a plan to sell its stake in the bank.

- Bernanke gave the market another fix of its favorite drug - commitment to keeping easy, cheap money flowing.

- France, Germany find common grounds for Greece assistance package involving the IMF (but euro makes new lows)

The potential Greece rescue deal continues to expose deep divides within the EU. It's getting pretty clear at this point that the clock is ticking and something must be done to prevent contagion. After all, the EU cannot afford to let Greece go down the path of Lehman Bros. Therefore, it is safe to assume that under pressure, EU leaders will announce a detailed deal within the next 48 hours. Depending on its conditions, the deal may provide a short relief to the euro but any rally is likely to fade quickly. Greek/German spread have actually come down since late January as the euro continued its precipitous decline. So a fix for Greece may not be a cure for the euro. So much of Europe's destiny is riding on perception. There will be buyers for Greek (Italian, Portuguese, Spanish) debt. The question is, at what cost? If risk perception is high, the cost of borrowing will be high - perhaps high enough to actually drive some of these sovereign nations to the brink.

As noted in previous post, 1175 was seen as the next resistance for the S&P and, indeed, the broad market index was unable to sustain this level. It is important to mention that this was more of a "psychological" level rather than a purely technical resistance/supply zone. The S&P finished the day with a very bearish candle formation, suggesting more downside may follow. After a nearly two month wild rally, and a rising VIX we should not be surprised to see a 1%~2% pullback to the 1150-1130 area. Falling stocks should weigh on commodities and commodity currencies and we may continue to see the Aussie and loonie lose more ground to the almighty (for now) dollar. AUDUSD chart indicates downside risk:

Thursday, March 25, 2010

Introducing Bloomberg "Hacks" Page

Bloomberg.com provides tremendous amounts of information and financial data, but it's not always easy to find or search for. Although virtually all of the data on bloomberg.com (the public site) is delayed, it can still be a valuable resource in assessing long term trends and shed light on current events. For example, you may look at German/Greek spreads to measure the risk premium investors charge to buy Greek debt. Likewise, you may look at the commercial CMBs spreads over treasuries to assess the commercial real-estate sentiment.

I decided to dedicate a separate page to keep track of this information. I will update the page periodically. If you have any suggestions on how to make it better or additional links that can be added, please let me know.

Thanks!

http://forexroy.blogspot.com/p/bloomberg-hacks.html

I decided to dedicate a separate page to keep track of this information. I will update the page periodically. If you have any suggestions on how to make it better or additional links that can be added, please let me know.

Thanks!

http://forexroy.blogspot.com/p/bloomberg-hacks.html

Wednesday, March 24, 2010

Blame it on the Weather

So, it was a really amazing weekend in New York and I was out and about, which explains the absence of my weekly summary/forecast post on Sunday. I have been pretty disciplined about writing my weekend review so I almost forgot how important it was. It is absolutely imperative to review the week that was, study the weekly and monthly charts, take into account recent fundamental developments and anticipate the markets direction based on the charts and calendar of economic events. Then, it is important to take all of that and formulate a working hypothesis for the week - a set of assumptions to frame our trading decisions. Personally for me, it is also important to do all of this on the weekend, when the market is closed and after spending at least 24 hours away from my monitor.

Well, better late than sorry so in lieu of the Sunday review, here's a little mid-week recap - a sort of Tuesday night quarterbacking, if you will. Here we go:

S&P 500

The S&P finished last week above 1150. This was largely seen as a bullish sign with a Friday confirmation close above a strong resistance level. However, until today (Tuesday) the S&P was not able to close above 1166, the resistance level we've identified days ago. Today's break above 1166 was decisive and happened toward the end of the day. It definitely looked like a good number of stop entries triggered on a break above 1170. At any rate, the next short term support/resistance levels for the S&P are 1175 and 1150. A break below 1150 might accelerate selling pressure with support seen at 1130 and 1115. This means that we are currently just a fraction of a point from another resistance level. A pullback at this point is all but certain. But hey, I could be wrong. The question is, what is the catalyst to push the market up or down. For sure, the Fed's commitment to keep rates low is a major factor. On the other hand, the Fed will end its MBS (mortgage backed securities) purchase program this month. No one knows for sure how it will impact mortgage rates and, in turn, real-estate prices but we already know that uncertainty and risk appetite do not go hand in hand. At any rate, if I set my bearish bias aside and just look at the chart, it looks like S&P is set to drift higher to 1200.

USD Index (DXY)

The strong inverse correlation that dominated the relationship between the USD and the S&P for much of 2009 seems like a distant memory. The relatively strong US recovery stands in stark contrast to the situation in the EU and the UK. This macro environment allowed US equities to rise to new monthly highs in tandem with the US dollar. One can only imagine that in a risk aversion scenario, the gap between the USD and the euro/GBP would be even greater - arguably, in such environment, the USD will stand to gain not only against the weak euro and GBP but also against the strong loonie, aussie, and Swiss franc.

As previously noted, the euro and GBP make up nearly 70% of the basket of currencies against which the DXY is calculated. This means that most of the recent strength in the DXY is due to weakness in the euro and pound, both of which face lingering issues and may suffer further weakness.

Euro - Greece

Germany's Merkel changed her stance a couple of days ago when she asserted that the IMF may be the only way to extend help to Greece. At the time the news came out, I thought a good chance for some relief to Greece and the euro was on the cards but that was not the case. A new round of political bickering commenced which helped push the euro even lower. The euro declined to new monthly lows against the Aussie and Swiss franc. As I write these lines, EURUSD is flirting with its 1.3450 support. A break below this level will most certainly trigger some stop sell orders waiting to be activated and send the euro even lower.

Only a clear plan for Greece and a cohesive EU stance can save the euro from sliding further. Euro sentiment remains bearish until then.

British Pound

The GBP suffered a massive slide on the backdrop of a weak UK economy coupled with an upcoming elections and accented with dovish BoE comments. At one point the pound even weakened against the euro. New economic data released today didn't help. Technically speaking, the pound looks the most vulnerable for further decline. At this very moment (3/24/09, midnight), GBPUSD seems well on its way to retest recent support at 1.4880 - 1.4800.

Japanese Yen

The yen maintained most of its strength despite the new highs in equities. As previously noted, at least some of the yen's strength should be attributed to repatriation which should abate by the end of the month, leaving the yen (risk appetite permitting) vulnerable.

Commodity Currencies

The loonie and Aussie continued to dominate the scene, with the loonie outpacing its Australian counterpart. The thought her is that the Aussie is vulnerable to further Chinese tightening but the Canadian dollar is less so. In addition, BOC has yet to raise interest rates while the RBA may not be willing to go much higher at this point.

OK - That's all for the time being. To be continued tomorrow....

Well, better late than sorry so in lieu of the Sunday review, here's a little mid-week recap - a sort of Tuesday night quarterbacking, if you will. Here we go:

S&P 500

The S&P finished last week above 1150. This was largely seen as a bullish sign with a Friday confirmation close above a strong resistance level. However, until today (Tuesday) the S&P was not able to close above 1166, the resistance level we've identified days ago. Today's break above 1166 was decisive and happened toward the end of the day. It definitely looked like a good number of stop entries triggered on a break above 1170. At any rate, the next short term support/resistance levels for the S&P are 1175 and 1150. A break below 1150 might accelerate selling pressure with support seen at 1130 and 1115. This means that we are currently just a fraction of a point from another resistance level. A pullback at this point is all but certain. But hey, I could be wrong. The question is, what is the catalyst to push the market up or down. For sure, the Fed's commitment to keep rates low is a major factor. On the other hand, the Fed will end its MBS (mortgage backed securities) purchase program this month. No one knows for sure how it will impact mortgage rates and, in turn, real-estate prices but we already know that uncertainty and risk appetite do not go hand in hand. At any rate, if I set my bearish bias aside and just look at the chart, it looks like S&P is set to drift higher to 1200.

USD Index (DXY)

The strong inverse correlation that dominated the relationship between the USD and the S&P for much of 2009 seems like a distant memory. The relatively strong US recovery stands in stark contrast to the situation in the EU and the UK. This macro environment allowed US equities to rise to new monthly highs in tandem with the US dollar. One can only imagine that in a risk aversion scenario, the gap between the USD and the euro/GBP would be even greater - arguably, in such environment, the USD will stand to gain not only against the weak euro and GBP but also against the strong loonie, aussie, and Swiss franc.

As previously noted, the euro and GBP make up nearly 70% of the basket of currencies against which the DXY is calculated. This means that most of the recent strength in the DXY is due to weakness in the euro and pound, both of which face lingering issues and may suffer further weakness.

Euro - Greece

Germany's Merkel changed her stance a couple of days ago when she asserted that the IMF may be the only way to extend help to Greece. At the time the news came out, I thought a good chance for some relief to Greece and the euro was on the cards but that was not the case. A new round of political bickering commenced which helped push the euro even lower. The euro declined to new monthly lows against the Aussie and Swiss franc. As I write these lines, EURUSD is flirting with its 1.3450 support. A break below this level will most certainly trigger some stop sell orders waiting to be activated and send the euro even lower.

Only a clear plan for Greece and a cohesive EU stance can save the euro from sliding further. Euro sentiment remains bearish until then.

British Pound

The GBP suffered a massive slide on the backdrop of a weak UK economy coupled with an upcoming elections and accented with dovish BoE comments. At one point the pound even weakened against the euro. New economic data released today didn't help. Technically speaking, the pound looks the most vulnerable for further decline. At this very moment (3/24/09, midnight), GBPUSD seems well on its way to retest recent support at 1.4880 - 1.4800.

Japanese Yen

The yen maintained most of its strength despite the new highs in equities. As previously noted, at least some of the yen's strength should be attributed to repatriation which should abate by the end of the month, leaving the yen (risk appetite permitting) vulnerable.

Commodity Currencies

The loonie and Aussie continued to dominate the scene, with the loonie outpacing its Australian counterpart. The thought her is that the Aussie is vulnerable to further Chinese tightening but the Canadian dollar is less so. In addition, BOC has yet to raise interest rates while the RBA may not be willing to go much higher at this point.

OK - That's all for the time being. To be continued tomorrow....

Thursday, March 18, 2010

Euro May Find Support as Germany Signals IMF Help for Greece Appropriate

EU leadership has been reluctant to even consider the possibility of IMF support for Greece - until today. Germany signaled IMF help may be appropriate after all. The idea is not without merit. The IMF can act somewhat independently of convoluted European politics. In addition, the EU will not be setting a dangerous precedence with a Greek bailout. IMF assistance may or may not be the best solution for Greece. But for the euro, that is not what really matters. What matters for the euro is a decisive plan of action that will put an end to weeks of political bickering.

The euro suffered some its worse one day declines on Thursday but as of this evening, EURUSD found support around 1.36 which coincided with Germany's comments regarding Greece and the IMF. A decisive plan of action, even if it eventually fails, will undoubtedly stoke a euro relief rally and pressure the US dollar.

The euro suffered some its worse one day declines on Thursday but as of this evening, EURUSD found support around 1.36 which coincided with Germany's comments regarding Greece and the IMF. A decisive plan of action, even if it eventually fails, will undoubtedly stoke a euro relief rally and pressure the US dollar.

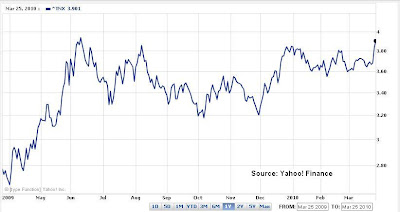

USD On The Move

US dollar is visibly stronger today across the board. The most obvious factor here is the failed Greek bailout plan. Euro dollar is the most widely traded currency pair and the euro is the biggest component of the DXY, the basket of currencies widely used to measure the dollar's strength. As such, material weakness in the euro will translate to USD strength against most of its trading counterparts.

Technically, the DXY chart looks strong. Despite a break below its recent channel (see chart below), the index bounced off its 50 day MA and, more importantly, bounced off its 79.50 support.

Other factors to consider: the S&P 500 is overextended and likely to pull back or trend sideways. As previously mentioned, 1166 is still a valid resistance for the S&P. A pullback in stocks will likely reduce risk appetite which may help the USD gain vs. the commodities currencies and further boost the dollar. In addition, there's some speculation regarding another unscheduled discount rate hike. The last hike was unscheduled and occurred exactly one month ago.

Taken together, the evidence is pointing to a stronger dollar on the backdrop of risk aversion.

CLICK ON CHART TO SEE LARGER IMAGE

Technically, the DXY chart looks strong. Despite a break below its recent channel (see chart below), the index bounced off its 50 day MA and, more importantly, bounced off its 79.50 support.

Other factors to consider: the S&P 500 is overextended and likely to pull back or trend sideways. As previously mentioned, 1166 is still a valid resistance for the S&P. A pullback in stocks will likely reduce risk appetite which may help the USD gain vs. the commodities currencies and further boost the dollar. In addition, there's some speculation regarding another unscheduled discount rate hike. The last hike was unscheduled and occurred exactly one month ago.

Taken together, the evidence is pointing to a stronger dollar on the backdrop of risk aversion.

CLICK ON CHART TO SEE LARGER IMAGE

Subscribe to:

Posts (Atom)